Strict Sanctions Against Russia – Options and Challenges

Authors: Aleksi Aleksishvili & Gocha Kardava

As tensions rise on the Ukraine-Russia border, western powers have been devising plans to counter any anticipated Russian aggression. While Ukraine prepares to protect itself against a possible Russian invasion, the US and the EU are putting together a list of sanctions to be imposed in the event of such a volatile development.

President Putin recognized the independence of Donetsk and Luhansk and ordered troops for “peacekeeping duties” in eastern Ukraine. Western countries evaluated this step as a violation of the Minsk Accord.

Directly after the press conference by President Putin, the effect was noticeable. RTS index, tracking top 50 Russian stocks on the Moscow Stock Exchange, lost more than 13% within a day, while ruble losses exceeded 3%.

EU and the US responded by immediate sanctions. Two Russian state-owned banks – VEB and Promsvyazbank are restricted from US financial system. The government prohibited Americans from engaging in business with Donetsk and Luhansk. Five people closely related to President Putin had been sanctioned. Additionally, sanctions had been imposed on Russian sovereign debt deals.

EU targeted 27 Russian individuals and organizations and 351 members of the Russian parliament. Trade with Donetsk and Luhansk has been prohibited. Germany stopped certification of NordStream 2 pipeline. Further sanctions had been imposed by the UK, Australia, and Japan.

While sanctions are being imposed step by step, the main question arises: How far sanctions can go? This article tries to explain some of the strictest sanction options and related challenges.

Briefly about Experience from 2014

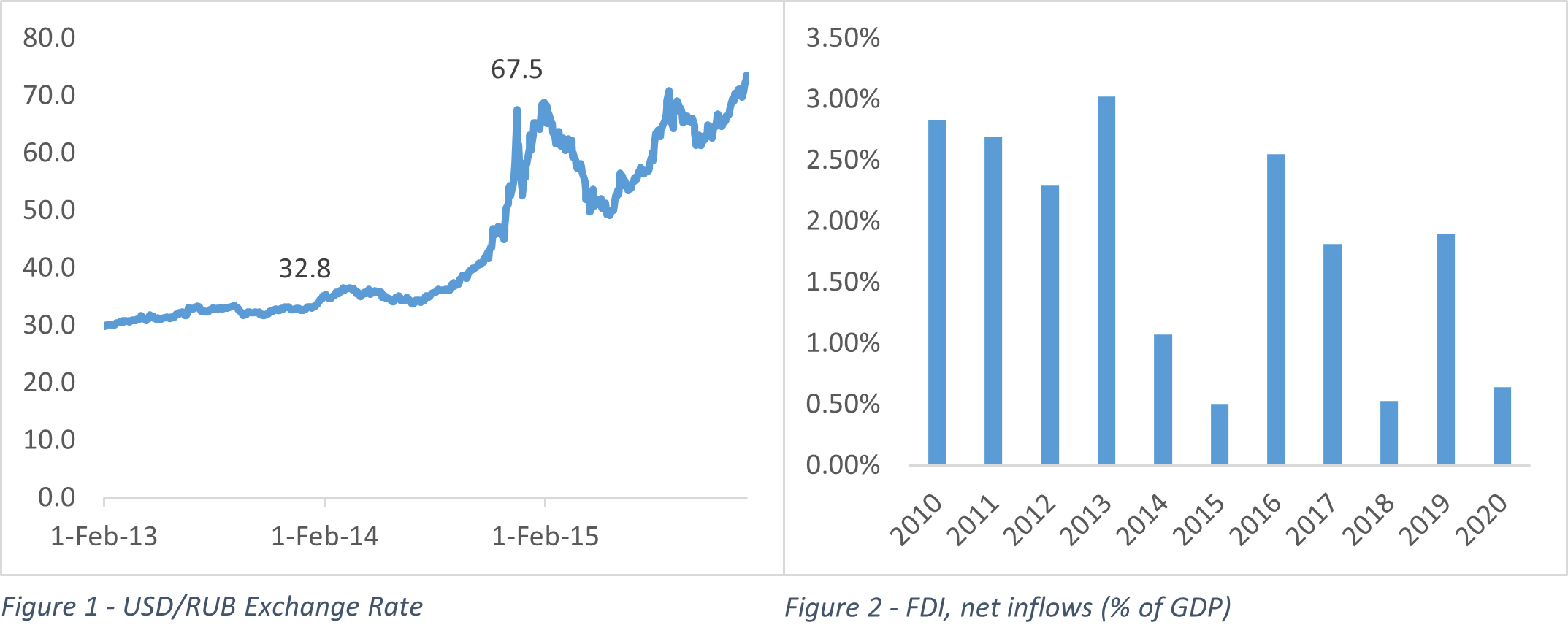

The experiences of the last decade or so may have taught the western authorities some valuable lessons. Specifically, in 2014, when Russia annexed Crimea, the West imposed sanctions and, according to various estimations, these hindered Russia’s annual economic growth by about 3%. Moreover, Russia experienced a major decline in FDI, depreciation of the national currency, and high capital outflow. The sanctions being prepared for the present-day crisis are expected to have an even heavier impact on the Russian economy.

In response to the invasion of Ukraine in 2014, the US imposed sanctions against Russia, targeting government officials, and entities operating in specific sectors of the economy and particularly elites close to President Putin. However, in many cases the targets of such sanctions were able to withstand them fairly comfortably. Eight years later, it is thus expected any such sanctions, if imposed, will be significantly firmer.

Targeting the Financial System

US officials have some drastic economic measures in mind, and will seek to attack the major financial institutions of Russia in the event of escalation. Targeting Russia’s biggest state banks would be expected to increase inflation, to further depreciate the Russian ruble, and could even precipitate a stock market crash. If the US government puts such targeted institutions or organizations on the Specially Designated Nationals and Blocked Persons List (known as the SDN List), they would be removed from the US marketplace. For entities and individuals on this list it is almost impossible to either engage in international transactions or, even more importantly, to conduct transactions denominated in US dollars. Wall Street’s largest banks are already on alert about potential sanctions, while the ECB has warned bank lenders dependent or related to Russia about the risks.

UK is another supporter of Ukraine. Parliament of the UK gave the power to the government to impose sanctions against Russia. The Russian-linked companies listed on London Stock Exchange will be primary target of the sanctions. Such companies include Gazprom, Rosneft, Sberbank, VTB, etc. Nevertheless, number of IPOs of Russian companies on London Stock Exchange have significantly decreased since annexation of Crimea in 2014, the still continued to raise funds in recent years.

Experts are especially curious about the potential disconnection of Russia from Society for Worldwide Interbank Financial Telecommunication (SWIFT), a global financial messaging system that connects financial institutions and provides a quick and secure money transferring service. It connects more than 11,000 financial institutions, and was responsible for more than 35 million transactions per day in 2020.

Being cut off from SWIFT would thus create significant challenges for Russian financial institutions, as cross-border transactions would be markedly disrupted.

In 2012, Iranian banks were expelled from SWIFT, including the central bank. Therefore, such a disconnection for a country is not unprecedented. However, compared to Iran, Russia is more closely connected to the international financial system and, therefore, the effect of such a measure would be much more severe for the country itself as well as its partners.

The threat of cutting Russia off from SWIFT was also raised back in 2014 when it annexed Crimea. To mitigate against the ramifications of such a measure actually being taken in the future, Russia developed its own financial messaging system. However, that does not mean Russia is invincible in this regard. The Russian system, known as SPFS, is a weak alternative to SWIFT. It has grown in popularity Russia and is frequently used by Russian banks, however it has a limited number of foreign users.

Removing Russia from SWIFT would also have harsh consequences for the international financial market as well. After all, it remains among the largest economies in the world and has tight financial linkages with other economies. Removing a player of such scale would thus naturally have a severe impact on global financial stability.

As it was already mentioned, Russia is not the first country threatened by cutting from the SWIFT. It can create concern for western countries. SWIFT turns out to be a matter of political speculation. Therefore, the necessity of alternatives increases. Payment systems, such as Chinese CIPS becomes more and more desirable. While autocratic regimes move to alternative payment systems, the effectiveness of strong options will gradually decrease.

Furthermore, if Russia was to be disconnected from SWIFT, the following important question arises: how would European countries pay for oil and gas imported from Russia? Even having to ponder this question shows just how severe an impact the cutting-off of Russia from SWIFT would have on European economies.

Importance of the Energy Sector

Another issue to bear in mind is whether trade sanctions are to be imposed on Russian oil and gas or not. To evaluate the desirability of imposing sanctions against Russian oil and natural gas, we must first analyze their role in the Russian economy, as well as in the European market.

In 2019, before the outbreak of the COVID-19 pandemic and considerable fluctuations on both markets, oil and natural gas together made up 60% of Russia’s exports and contributed to more than 30% of its GDP.

In the same year, oil and natural gas were responsible for 39.3% of budget revenues. However, due to a significant drop in prices during 2020, this share decreased to 28.0%. Thereafter, in 2021, recovered to provide 35.8% of budget revenues and even leading to a budget surplus.

These indicators demonstrate just how important the oil and gas markets are for Russia. Targeting these with sanctions would thus have a significant impact on the Russian economy, while maintaining long-term sanctions could even lead to economic collapse.

It is important not to overlook the indirect effects of such sanctions. If the Russian economy depends heavily on oil and gas, then Europe, in turn, depends on Russian oil and gas. Strict measures, if implemented, would cause a sharp increase in energy prices, which are already about four times higher in the mid of February relative to the same period of last year.

Concerningly, the escalation of the situation on the Ukraine-Russia border and the potential imposition of sanctions create a threat to European energy security. In 2021, 38% of total natural gas consumed in the EU was imported from Russia, making it the main supplier of this resource to the EU. Due to environmental and security-related factors, some EU countries had started to reduce their energy generation from domestic sources or began to pursue alternative sources of energy.

Europe gets natural gas from a few major pipelines, forming an interconnected system. One of the most important pipelines goes through Ukraine. However, in recent years, the flow of natural gas through Ukraine has decreased significantly and currently it stands somewhere around one-third of its natural rate. Other important routes include the Yamal pipeline going through Belarus and Poland, Nord Stream 1 connecting Russia to Germany through the Baltic Sea, and TurkStream, which provides natural gas to Turkey as well as southern Europe. Elsewhere, Nord Stream 2 has already been built and is awaiting certification, but Germany has already announced to stop certification process until the de-escalation of the situation in Ukraine.

Due to drilling-related earthquakes, the Netherlands announced the gradual closure of its major plant in Groningen. However, as market conditions worsened and energy security risks in Europe increased, the Dutch government announced it would be increasing production. The initial plan for 2022 was to produce 3.9 billion cubic meters, but that has since nearly doubled to 7.6 billion cubic meters. Even the increased output is far behind from the historical level, as for example, in 2013 field produced 53.8 billion cubic meters.

Meanwhile, Norway is the second-largest supplier of natural gas to the European market. The existing infrastructure allows it to increase the flow of natural gas to Europe, and most pertinently to Germany, which is the largest consumer among European countries. However, the Prime Minister of Norway, Jonas Gahr Store, emphasized that Norway is already delivering at its maximum capacity and will not be able to make up for any shortcomings caused by sanctions on Russia.

Another option for Europe is LNG, which is natural gas, cooled down to liquefied form, making it more energy-dense and therefore more suitable for transportation. There are a few potential providers of LNG, which can provide additional supplies to Europe. In particular, Qatar and Japan have agreed to divert further supplies to the EU, while due to price fluctuations the US has already increased its LNG exports to Europe.

However, there are two main constraints to bear in mind regarding LNG. First, the supplies of LNG are limited and, as reported by Reuters, global liquefaction capacity is already almost fully utilized. The second constraint concerns infrastructure. To receive LNG, appropriate terminals are necessary. In 2021, the existing infrastructure was sufficient to cover approximately 40% of the natural gas demand of Europe. However, to utilize maximum capacity, proper supply chain management will be required, which is difficult to achieve in a short period of time.

Currently, Russia’s income from oil is much higher than from natural gas, potentially making this industry the primary target for sanctions. The main alternative source for Europe is Saudi Arabia. However, extraction and transportation capacities are significant complications here, making it a questionable substitute for Russian oil.

Even though there are some alternatives to Russian oil and gas for Europe, building effective and efficient supply chains in a short period would be exceptionally challenging. In these circumstances, direct sanctioning of oil and natural gas is less probable. However, Russia is dependent on imported extraction machinery, which could be targeted instead. If so, the medium- and long-term development of the industry in Russia would be decelerated. Suggested by Atlantic Council, in 2013, the potential of import substitutability of Russia for machinery and electrical and optical equipment stood somewhere between 30-35%. If the U.S. Department of Commerce invokes the foreign direct product rule, American companies would be prohibited from trading with sanctioned companies. Such a step would hinder the growth of strategically important industries for Russia.

No More Illusions

Sanctions would have wide-reaching implications, harming other economies as well as that of Russia. Does this mean that severe sanctions will not be imposed? Briefly put, no. In 1909, the British journalist Norman Angell wrote a pamphlet entitled “Europe’s Optical Illusion.” It stated that international trade and financial markets were so interconnected that any disruption in the supply chain would have a hugely negative effect on belligerent nations. Therefore, Angell claimed that any benefits of war were illusory. It soon became a bestseller, and the idea of the impossibility of war spread all around the globe. However, within five years of the pamphlet’s publication, Europe found itself embroiled in the First World War. With this in mind, expected high cost does not mean that the most severe sanctions will not be imposed. The main quandary now is whether Russia will invade Ukraine-controlled territory or not. If it does, many nations should prepare for severe consequences.

Resources:

“Cutting off Russia from SWIFT will really sting” by Harley Balzer, Atlantic Council

“What Happens if Russia Cuts Off Europe’s Natural Gas?” By Stanley Reed, The New York Times

“U.S. Sanctions Aimed at Russia Could Take a Wide Toll” By Michael Crowley and Edward Wong, The New York Times

“Factbox: What are Europe’s options in case of Russian gas disruption?” By Nina Chestney, Reuters

“Ukraine: What sanctions are being imposed on Russia?” BBC

“U.S. Treasury Imposes Immediate Economic Costs in Response to Actions in the Donetsk and Luhansk Regions” – US Department of The Treasury