Issue 34: Exchange Rate Dynamics – November 2014

|

Dynamics of Exchange Rate – November 2014

Issue #34 / 10.12.2014

|

||

|

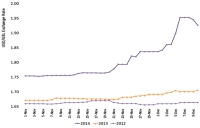

On December 10, 2014, the official exchange rate set by the National Bank of Georgia is 1.93 GEL to 1 USD. During the last three weeks GEL depreciated against the USD by 0.18 units.

At the peak, exchange booths were selling 1 USD at 2.05 GEL. The depreciation of the GEL in such an extent was out of the logic, despite taking into the consideration the fundamental aspects (trade balance worsened, remittances from abroad declined, the flow of the tourists slowed down), which affected negatively on the GEL exchange rate.

The sharp depreciation of the GEL was basically due to the speculations of the market players, also due to the panic reactions of the population as well as businesses, converting the GEL into the USD.

|

||

| Daily Exchange Rates, 2012-14 | ||

Source: National Bank of Georgia

|

The GEL exchange rate against the USD remained stable till November 2014. During the period of January-October, the USD appreciated against the other currencies (EURO, Russian Ruble, Ukrainian Hryvnia and Armenian Drams). In this period, the Real Effective Exchange Rate of the GEL (against USD, Russian Ruble, Ukrainian Hryvnia, Euro, Turkish Lira) also appreciated by 6.4% (October, 2014).

Since November 20, 2014, the GEL depreciated against USD. On December 10, 2014, the official exchange rate set by the National Bank of Georgia is 1.93 GEL to 1 USD.

The GEL exchange rate had the trend of short term fluctuations against the USD also at the end of 2013. This was basically due to the seasonal factors and increase of the budget expenditure (20.7%) in the IVQ 2014.

|

|

|

The GEL exchange rate is also affected by the following fundamental factors: FDI, money transfers, the public external debt (new debt and debt service), trade balance (export and import) and the flow of the tourists in the country. In addition, money in circulation outside of the commercial banks and the volume of the deposits denominated in GEL in commercial banks (M2) also affects the stability of the GEL exchange rate.

|

||

| Dynamics and Growth Rate of FDI | ||

|

FDI

During the first three quarters of 2014, the volume of the FDI (923.3 mln. USD ) significantly exceeds (29.1%) the corresponding indicator of 2013 (due to increase of the FDI in Q3, 507.5 mln. USD). This indicates that the foreign currency inflow from this source increased. The sharp growth (99%) of the FDI in the 3Q 2014 maintained the stability of the GEL exchange rate during this period.

The top five partner countries in the 3Q of 2014 are: China (29.3%), Azerbaijan (18.7%), Netherlands (17.7%), Panama (8.7%) and the United Kingdom (5.4%). The highest shares of the FDI are in the following sectors: construction (35.7%), transport and communication (21.4%) and real estate (12.0%).

|

Source: GeoStat

|

|

| Monthly Dynamics of Trade Balance, 2012-14 | ||

|

Source: GeoStat

|

Trade Balance

In October 2014, the volume of the export declined (-5.1%; -14.7 mln. USD) and the volume of the import increased (8.7%; 62.7 mln. GEL) in comparison with the corresponding indicators in 2013.

Hence, the trade balance worsened (-17.9%; -77.4 mln. USD). This indicates that the inflow of the foreign currency from this source decreased and the outflow of the foreign currency increased in the mentioned period.

Number of The Foreign Visitors

One more source of the foreign currency inflow is the number of the foreign visitors (tourists) in the country.

This indicator declined In November (-3.9%), as well as in October (-2.5%) and September (-2.1%) 2014 in comparison with the indicators of the same months in 2013. This indicates that the inflow of the foreign currency from this source would have also been declined.

|

|

| Money Transfers by Months, 2012-14 | ||

|

Money Trasfers

In the period of January-October 2014, the volume of the money transfers from abroad (1 220 mln. USD) exceeds (1.6%) the corresponding indicator in 2013. In October, this indicator (123.9 mln. USD) declined compared to October 2013 (-6.5%). Money transfers declined basically from Russian Federation (-11.1 mln. USD), Greece (-1.6 mln. USD), Ukraine (-1.5 mln. USD), United Kingdom (-0.2 mln. USD) and Spain (-0.2 mln. USD.

Money transfers from Georgia to abroad is one of the source of the foreign currency outflow from the country. In the period of January –October 2014, the volume of the money transfers from Georgia to abroad (142.2 mln. USD) exceeds (13.6%) the corresponding indicator in 2013. Also the indicator of October 2014 increased (10%, 2.1 mln. USD) in comparison to October 2013.

|

Source: National Bank of Georgia

|

|

| Public External Debt , 2012-14 | ||

|

|

Public External Debt

One more source of the foreign currency inflow in the country is external debt and one more source of the foreign currency outflow is the costs incurred on debt service and debt repayment.

During the three quarters of 2014, the government issued 519.4 mln GEL new external debt. In this period the costs incurred on debt service and repayment is 470. 1 mln. GEL. Among them, the expenditure on debt service (percent) was 90.6 mln. GEL and on debt repayment was 379.5 mln. GEL.

During the first nine months of 2014, the public external debt decreased (-3.3%) compared to 2013. This indicates that the foreign currency inflow from this source was lower compared to the foreign currency.

|

|

| Source: Ministry of Finance of Georgia | ||

| Dynamics and Growth Rate of Monetary Aggregates (M2) | ||

|

Money Aggregates (M2)

One more aspect, which affects the stability of the currency exchange rate is the volume of the currency in circulation outside of the commercial banks and the volume of the deposits in the commercial banks, excluding the deposits of the banks public sector (M2). In October 2014, this indicator increased (10.8%) compared to the October 2013, but this could not have significant impact on the depriciation of the GEL exchange rate against dollar.

It should also be mentioned, that the rapid increase of the USD/GEL exchange rate (Depreciation of the GEL) increases the cost of converting the GEL into the USD. Hence, the burden of the loan service for the debtors also increases. In October 2014, the large share of the loans to the economy is denominated in the foreign currency (61.2%, 4.06 bln. USD) and 35.5% of it is loans to the individuals.

|

Source: National Bank of Georgia

|

|

|

|

||

|

||