Issue 28: Banking Sector – July 2014

|

Banking Sector – July 2014

ISSUE #28 / 12.09.2014

|

||||

|

In the period of January-July of 2014, commercial banks’ net profit increased (11.6%) compared to the same period of 2013 and reaches 214.9 mln. GEL.

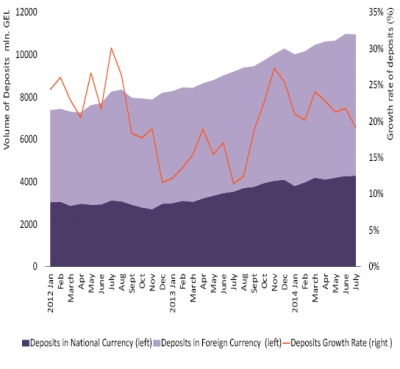

In July 2014, the volume of deposits’ stocks increased (19.1%) in comparison with July 2013 and reached 10.953 mln.GEL. The volume of loans to the national economy also increased (23.2%) and reached 10.816 mln. GEL.

|

||||

| Volume and growth rate of deposits | ||||

|

In July 2014, the volume of deposits increased (19.1%) compared to July 2013 . Deposits denominated in both, national (GEL) , as well as in foreign currency (17.9%) increased (21%;17,9%).

The share of deposits denominated in foreign currency (60.9%) still exceed the share of deposits denominated in national currency (GEL) (39.1%). But, it is worth mentioning that the share of depoists denominated in foreign currency has decreasing trend and the indicator of July 2014 is lower (-0.6% points) than the coresponding indicator of July 2013. This fact indicates reduction of ievel of dollarization, which is due to the policy implemented by National Bank’s policies, including an approval of Commercial Banks’ standard certificate of deposits and an extension of the base of mortgage, which is used for operations with National Bank.

In July 2014, the interest rate on deposits decreased (-0.4% percentage points) compared to July 2013 and equals to 6.1%. The reduction of interest rate is obsereved on deposits denominated in National currency (GEL) (-0.2% points), as well as on deposits denominated in foreign currency (-0.5% points).

|

|||

| Dynamics and growth rate of the loans to the national economy | ||||

|

In July 2014, the indicator of the loans to the national economy exceeds (23.2%) the corresponding indicator in July 2013. Both, the indicators of the volume of loans in GEL as well as in foreign currency increased (44.3%, 10.6%).

In July 2014, there is increase as in loans of Individuals (31.1%) as well as in loans of Legal Entities (16.0%) which indicates the economic activity growth.

In July 2014, the interest rate decreased on loans of Legal Entities as in Foreign Currency (-1.6% points) as well as in National Currency (-1.6%). Also the interest rate decreased on loans of Individuals, as in Foreign Currency (-0.4% points) as well as in National Currency (-0.8% points).

|

|

|||

|

|

|

|||

|

Dynamics of export to Ukraine for three major commodities

|

||||

|

|

|

|||

|

In July 2014, 50.8% of loans granted by Commercial banks to the total economy are the loans in various sectors of economic. Among them the largest shares have: Trade sector (31.1%) and Manufacturing (22.7%). In addition, these sectors had the largest contribution to GDP formation in the I quarter of 2014.

In July of 2014, the structure of loans denominated by types of activities changed compared with the previous periods, which is caused by a renewal of Banks’ customers Activity Base.

|

||||

|

|

||||

| Share of Major Commodity Positions by Export to Ukraine, I quarter 2014 | ||||

|

In July 2014, 49.2% of total loans’ are loans to Households. The share of loans secured by Real estate in loans to Households is 44.6% and the share of consumer loans is 37.0%.

During this period, increased as volume of Consumer loans (35.7%), as well as volume of Loans secured by Real estate (34.6%) compared to July 2013.

|

|

|||

| |

||||

| Dynamics of NPLs and its share in Total Loans | ||||

|

In July 2014, the volume of non-performing loans increased (24.2%) that resulted increase of share of non-performing loans (9.5%) in total loans by 0.5 percentage point in comparison with July 2013.

The dynamics of overdue loans is also an important indicator of Financial Stability. In July, 2014 the volume of this indicator is 358mln. GEL. Which amounts 3.3% of total loans. The volume of this indicator, as well as its share in Total loans, decreased (-4%, 0.9% points) compared to July 2013.

|

|||

|

|

||||

|

||||