Issue 45: State Budget Revenues – I Q, 2015

|

State Budget Revenues – I Q, 2015

Issue #45 / 08.05.2015

|

||

|

In the first quarter of 2015, the state budget revenues increased (14.6%) compared to the first quarter in 2014. Among them, tax revenues increased by 11.5% (189.1mln. GEL), grants by 6 times (48.7 mln. GEL) and the other receipts by 21.4% (11.4 mln. GEL). In this period the revenues increased from profit (26.5%), value added (11.8%), income (4.5%) and excise (11.3%) and declined from import (-22.6%) taxes.

In the first quarter of 2015, the state budget expenditures also increased (8.8%) in comparison with the indicator of the same period in 2014. Among them, expenditures on percent increased by 40.5%, on payments of employees by 10.1%, on social protection by 9.6%, on subsidies by 8.1%, on grants by 4.5%, on goods and service by 2.6% and on other expenditures by 7.1%.

|

||

| Sources of State Budget Revenues, 2015 | Tax Revenues, 2012-2015 | |

|

Source: Ministry of Finance of Georgia

|

Source: Ministry of Finance of Georgia

|

|

|

In the first quarter of 2015, the volume of the state budget revenues reaches 1 951.1 mln GEL. This indicator increased by 249.2 mln. GEL compared to the same the corresponding period of 2014. It exceeds the planned state budget revenues of the first quarter 2015 by 4.3 % (81.1 mln. GEL) and is 24. 1% of the planned annual state budget revenues.

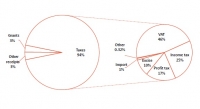

In this period, 93.7 % of the state budget revenues was from taxes, 3 % from grants and 3.3 % – other receipts (which includes revenues from interests, dividends, rents, realization of goods and services, licence and permit fees and transfers).

The largest source of the state budget revenues (1,828.5 mln. GEL) is still tax revenues, with an increase of 11.5 % compared to the first quarter of 2014. It exceeds the volume of the planned tax revenues of the first quarter of 2015 by 2.7% and is 24.1% of the planned annual tax revenue of 2015. Tax revenues increased in January (8%), as well as in February (4.8%) and March (18.5%), but like previous years the highest growth was recorded in March.

In the first quarter of 2015, the volume of the state budget expenditures reaches 1 765.8 mln. GEL. This indicator increased (143.4 mln. GEL) compared to the first quarter of 2014 and is 22.1% of the planned annual expenditure for 2015.

In this period, the structure of the state budget expenditures is the following: social protection (37.2%), payment of employees (18.7%), grants (13.5%), other expenditures (12.9%), goods and service (10.2%), percent (4.2%) and subsidies (3.3%).

|

||

| Revenue from the Value Added Tax, 2012-2015 | ||

|

In the first quarter of 2015, the largest source (46.4%) of the tax revenues was the value added tax at 848.6 mln. GEL.

In this period, revenue from VAT increased by 11.8% (89.8 mln. GEL) compared to the corresponding period in 2014.

In the first quarter of 2015, the largest growth of VAT was recorded in March (24.6%). In January, the VAT increased by 2.7%, and in February, by 12% compared to the corresponding months of 2014.

|

Source: Ministry of Finance of Georgia

|

|

|

|

||

| Income Tax Revenue, 2012-2015 | ||

|

In the first quarter of 2015, the second largest source (25.2%) of the tax revenues was income tax.

In this period, revenue from income tax is 460.4 mln. GEL, which exceeds the revenue from income tax in 2014 by 4.5% (19.9 mln. GEL). This is lower (-1.6 %; -7.72 mln. GEL) than the planned income tax of the first quarter 2015.

The revenue from income tax increased in both January 2015 by 10.8% and March by 9.2%, while in February, revenue decreased by -0.1% compared to the corresponding months of 2014.

|

Source: Ministry of Finance of Georgia

|

|

| Excise Tax Revenue, 2012-2015 | ||

|

Source: National Statistics Office of Georgia

|

In the first quarter of 2015, 9.7% of the tax revenues was received from excise tax. This increased by 11.3% (17.9 mln. GEL) in comparison to 2014 and totalled 176.8 mln. GEL, however this is less than the planned income from excise tax for the first quarter of 2015 by 8.4%.

The revenue from excise tax increased by 38.5% in January and by 0.7% in March, while it decreased by 10.5% in February in comparison to the corresponding months of 2014.

|

|

| Import Tax Revenue, 2012-2015 | ||

|

In the first quarter of 2015, revenue from import tax was 1% (17.7 mln. GEL) of the total tax revenue. This indicator is lower by 22.6% than the import tax from the corresponding period in 2014. The revenue from import tax declined in January (33.7%) as well as in February (14.5%) and March (18%).

In the first quarter of 2015, revenue from import tax decreased because of the decrease in the volume of imports (3.3%; 59.9 mln. USD), which was caused by the currency exchange rates fluctuations.

|

Source: National Statistics Office of Georgia

|

|

|

|

||

|

||