Issue 92: Banking Sector, January-February, 2017

|

Banking Sector, January-February 2017

Issue #92/ 24.04.2017

|

||

|

According to data for February 2017, compared to the corresponding period in 2016:

• The volume of deposits increased by 7.4%;

|

||

|

Source: National Bank of Georgia

|

|

Source: National Bank of Georgia

|

|

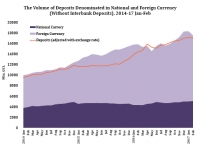

According to data for February 2017, compared to the corresponding period in 2016, the volume of deposits increased (7.4%)*. There was a significant increase in the volume of deposits denominated in the national currency (17.2%), while the deposits in foreign currencies increased by 3.7%.

The interest rates on deposits denominated in the national currency have been characterized by more volatility compared to the interest rates on deposits denominated in foreign currencies. According to data for February 2017, the difference between interest rates on deposits denominated in national and foreign currencies reduced (-1.2 percentage points) and amounted to 5.8%. The average interest rate on deposits denominated in national currency was 8.8% while in foreign currencies it equaled 3.0%.

|

||

|

|

|

|

|

According to data for February 2017, compared to the corresponding period in 2016, the volume of loans increased significantly (15.4%)*. This is mostly due to the significant increase of loans denominated in national currency (23.2%), while the loans denominated in foreign currencies increased by only 6.5%.

The interest rates on loans denominated in the national currency have been characterized by more volatility compared to the interest rates on loans denominated in foreign currencies. According to data for February 2017, the difference between interest rates on deposits denominated in national and foreign currencies reduced (-0.8 percentage points) and amounted to 12.4%. The average interest rate on loans denominated in national currency was 20.9% while in foreign currencies it equaled 8.4%.

————————–

|

||

|

Source: National Bank of Georgia

|

|

|

|

In the period of January–February 2017, the structure of loans by economic sector changed significantly. The share of trade (-2.9 percentage points) and industry (-1.7 percentage points) in total loans reduced. Meanwhile, the share of construction (2.2 percentage points), health care (0.9 percentage points) and hotels and restaurants (0.8 percentage points) in total loans increased.

Based on data for February 2017, the volume of non-performing loans increased (5.8%, 73 mln GEL) compared to the corresponding indicator in 2016, while the share of non-performing loans in total loans decreased (-0.6 percentage points) and amounted to 7.4%. This was mostly due to the depreciation of the GEL. In this period, reserves covered 48% of total non-performing loans.

|

||

|

|

||

|

In the period of January-February 2017, the quantity of loans up to 1,000 GEL decreased significantly (-316,743 units), while the loans of the same volume but denominated in foreign currencies increased by 5,705 units. In contrast, the quantity of loans in the range of 1,000-100,000 GEL increased by 63,612 units, while the loans with the same volume but denominated in foreign currencies decreased by 4,662 units. This reduction is mostly due to the larization program.

The quantity of loans exceeding 100,000 GEL increased in the national currency as well as in foreign currencies. However, the quantity of loans denominated in the national currency is significantly higher (15 times) than the quantity of loans denominated in foreign currencies.

|

||

|

Source: National Statistics Office of Georgia *Preliminary Data

|

||

| PMCG Research | Mariam Saghareishvili | +995 2 921 171 | http://www.research.pmcg-i.com| |

||