Issue 79: State budget compliance – 2016, I-II Quarters

|

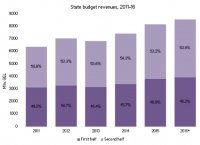

State budget compliance – 2016, I-II Quarters

Issue #79 / 02.09.2016

|

||

|

In the first half of 2016:

• State budget revenues are executed by 100.5%, while expenditure – by 95.8%.

• Expenditure on social benefits significantly increased (12.1%; 161.8 mln GEL) compared to the corresponding period in 2015. This might be due to the increase the expenditure on public health (23.4%; 62.5 mln. GEL).

|

||

|

Source: Ministry of finance

|

|

|

|

|

||

|

|

Source: Ministry of finance

|

|

|

In the first two quarters of 2016 tax revenues increased (4.6%; 163.5 mln GEL). This increase was mostly due to the growth of revenue from unclassified taxes (30-fold; 315.6 mln GEL)* and excise tax (31.8%; 118.9 mln GEL). It is important to note that revenues reduced from VAT (-11.2%; -186.6 mln GEL), income tax (-2.7%; -24.7 mln GEL), profit tax (-10.0%; -56.8 mln GEL) and import tax (-8.4%; -3.0 mln GEL).

Revenues from VAT in 2016 exceeded the corresponding indicator of 2015 only in February (3.3%; 8.3 mln GEL). In all other months, there was a significant reduction: January – 25.1%, March – 17.2%, April – 4.5%, May – 6.1% and June – 13.1%.

* This can be explained by the fact that in 2016 the method to distribute collected tax revenue between specific tax categories changed. More specifically, the total tax revenue is now accumulated in a general account before being distributed.

|

||

|

Source: Ministry of finance

|

Source: Ministry of finance

|

|

|

In the first half of 2016 compared to the corresponding period of 2015, state budget expenditures increased in the following categories: social benefits (12.1%; 161.8 mln GEL), remuneration (6.0%; 40.2 mln GEL) and subsidies (33.5%; 36.9 mln GEL), while expenditure on grants reduced (-25.1%; -137.2 mln GEL).

The volume of social expenditures, in the first half of 2016 exceeded the corresponding indicator of 2015 in all months. The highest increase was in June (21.5%; 46.4 mln GEL). This might be due to the increase the expenditure on public health (23.4%; 62.5 mln. GEL).

|

||

|

Source: Ministry of finance

|

|

|

|

Source: Ministry of Finance of Georgia * Forecasted

|

||