Issue 78: Banking Sector – 2016, I-II Quarters

|

Banking Sector – 2016, I-II Quarters

Issue #78 / 12.08.2016

|

||

|

In June 2016 compared to the corresponding period in 2015:

• The volume of deposits (13.5%) and the volume of loans (11.2%) increased.

|

||

|

Source: National Bank of Georgia

|

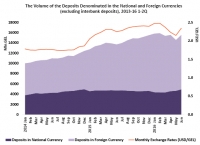

In June 2016, the volume of total deposits, excluding interbank deposits, amounted to 15.6 mln GEL, which exceeds the indicator of 2015 by 13.5%. The volume of deposits denominated in the national currency increased by 4.8%, while the volume of deposits denominated in foreign currencies increased by 18.1%. However, taking exchange rates into consideration, the growth rate of deposits denominated in foreign currencies was actually only 13.4%.

In June 2016, the average interest rate on the deposits is 4.8% which is less than the corresponding indicator in 2015 by 0.4%. Average interest rates denominated in foreign currencies is 3.3%, which is lower (-1.2%) than the same indicator of the previous year. In this period, the average interest rate on the deposits denominated in the national currency increased (0.7%) and equalled 8.4%.

|

|

|

In June 2016, the volume of loans issued by commercial banks (excluding interbank loans) reached 16.5 mln GEL, which exceeds the corresponding indicator in 2014 by 11.2%. Here, the volume of loans denominated in the national currency increased by 5.7%, while the volume of the loans denominated in foreign currencies increased by 14.3%. However, taking exchange rates into consideration, the growth rate of the loans denominated in foreign currencies was actually only 9.7%.

In June 2016, the average interest rate on the loans reduced and equals 13.5%. In the same month of this year, loans denominated in foreign currencies was 9.2%, which is 2.3% lower than the indicator of 2015. On the other hand, the average interest rate on loans denominated in the national currency increased by 0.8% and equalled 19.2%.

|

Source: National Bank of Georgia

|

|

|

|

In June 2016, the largest sectors by volume of loans to the economy are trade (12.5%), industry (11.0%) and construction (4.1%). In this period, compared to June 2015, the volume of loans to the construction sector (41.9%; 199.1 mln GEL) and to industry (11.9%; 194.5 mln GEL) increased significantly, while loans declined to trade (-11.3%; 194.0 mln GEL).

|

|

|

In June 2016, the number of loans secured by real estate (53.5%) and consumer loans (29.4%) make up the largest share of household loans.

Overall, 79.4% of the consumer loans are denominated in the national currency, while 20.6% of this indicator are denominated in foreign currency. Loans secured by real estate have a different structure, with 84.3% denominated in foreign currencies, and 15.7% denominated in the national currency.

In June 2016, the volume of consumer loans increased by 1.8% while the volume of loans secured by real estate increased by 25.4%.

|

Source: National Bank of Georgia

|

|

|

Source: National Bank of Georgia

|

The quality of the credit portfolio of a commercial bank is determined by its share of non-performing loans and overdue loans in the total loans.

In June 2016, the volume of the non-performing loans increased by 8.4% (103.5 mln GEL) compared to the previous year and amounted to 1340.9 mln GEL. The share of non-performing loans in the total loans declined by 0.2% and equalled 8.1%. In this period, the reserves of non-performing loans amounted to 50.3%.

In June 2016, the volume of overdue loans also increased (16.7%; 50.6 mln GEL). Its share (374.2 mln GEL) in the total loans equalled 2.3%.

|

|

|

In the first half of 2016, the income of commercial banks decreased (-13.7%; 250.5 mln GEL) compared to the corresponding period of 2015. Income from interest increased (10.1%; 105.8 mln GEL), while non-interest income reduced (-72.3%; 436.7 mln GEL).

In this period, in the category of interest income, the income from loans (8.6%; 83.3 mln GEL), from securities (33.3%; 25.5 mln GEL), from “nostro” accounts* (49.1%; 1.8 mln GEL), and there was also an increase from other sources (-22.7%; 3.9 mln GEL). In the category of non-interest income, income from securities trading declined (-11.7 mln GEL) while other non-interest income (-72.3%; 436.7 mln GEL) declined, which includes dividends received, profit/loss from re-evaluation of currency resources and from property sales. On the other hand, income reduced from conversion operations (-2.7%; 76.3 mln GEL) from fees and commissions (13.6%; 15.8 mln GEL).

In the first half of 2016, the net profit of commercial banks increased by 19.6% compared to the previous year, amounting to 290.7 mln GEL.

* Bank accounts at the corresponding bank on which interpayments are reflected.

|

Source: National Bank of Georgia

|

|

|

Source: Ministry of Finance of Georgia * Forecasted

|

||