Issue 66: Analysis of the External Factors Affecting on GEL Exchange Rate

|

Analysis of the External Factors Affecting on GEL Exchange Rate

Issue #66 / 02.02.2016

|

||

|

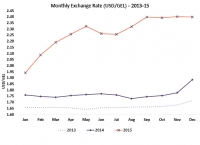

During the January 2016, GEL depreciated towards USD by 0.08 point (3.1%) compared to previous month and by 0.5 point (25.5%) compared to January 2015. This issue reviews the dynamics of the key indicators, which maintain the inflow and outflow of the foreign currency in Georgia, such as: International Trade (Export and Import), Remittances, Visitors in Georgia, Foreign Direct Investments (FDI) and Public External Debt.

|

||

|

|

|

|

|

Source: National Bank of Georgia

|

||

|

Based on the preliminary data, in 2015, compared to 2014, the volume of export declined by 23.0% (-657.0 mln USD) and the volume of import declined by -10.1% (-869.0 mln USD)*. This means that outflow of foreign currency declined more than inflow of foreign currency did. Due to the fact, that the volume of import declined more compared to the decrease of volume of export, external trade balance improved by 211.9 mln USD.

* This indicator includes medicines for hepatitis C, which was given as a present to the country, hence was not followed by the outflow of foreign currency. If we don’t count corresponding value (447.0 mln. USD) in import, than in this period the volume of import is 1 316 mln. USD, which is lower (15.3%) than corresponding indicator in 2014. Hence, trade balance has improved by 659.0 mln. USD.

|

Source: GeoStat

|

|

|

|

In 2015, the volume of remittances to Georgia is 1080.0 mln.USD, which is 25% lower compared to the corresponding indicator in 2014. Among them, 40.1% of remittances flowed from Russia, 10.9% – from Greece, 10.1% – from Italy, 9.3% – from USA, 6.4% – from Turkey and 23.2% from the other countries. Money transfers declined mostly from Russia (-39.0%; -276.6 mln.USD), from Greece (-42.5%; -87.0 mln.USD), from Italy (-10.2%; -12.4 mln.USD) and from Ukraine (-32.3%; -10.0 mln.USD). The remittances from Georgia to abroad is the source of foreign currency outflow. In 2015, the remittances from Georgia to abroad amounted 170.8 mln. USD, which is lower (4.1%) than the same indicator in 2014. Remittances increased to Russia (6.7%), Turkey (21.2%), Moldova (66.3%), Czech Republic (65.8%) and Kazakhstan (12.9%).

|

|

|

One of the important sources for foreign currency inflow to Georgia is number of foreign visitors (tourists). In 2015 , 5 897 685 individuals visited Georgia. This indicator exceeds the indicator of previous year by 6.9% (382 100 individuals). During the first three quarters of 2015*, the volume of service export is 2 406.9 mln. USD, which exceeds the corresponding indicator in 2014 by 3.4% (79.6 mln. USD).

* The indicator of all four quarters of 2015 will be published by the end of March.

|

|

|

|

|

In the first three quarters of 2015, the volume of FDI declined by 17.3% compared to the corresponding period of 2014. During the first and third quarters of 2015, the indicator of FDI declined (-43.4%; -32.6%), while during the second quarter it showed significant growth (80.8%).

|

|

|

Additional source of foreign currency inflow in the country is Public External Debt and source of foreign currency outflow is the debt service. In December 2015, the total volume of Public External Debt is 4 314.9 mln.USD and 115.1 mln.USD of it is borrowed in 2015. In this period, the total volume of debt service and repayment is 245.4 mln.USD. Among them, the volume of debt service is 77.1 mln.USD and the volume of debt repayment – 168.3 mln.USD.

|

|

|

|

Based on the above mentioned information, the decline of foreign currency inflow was followed by GEL exchange rate depreciation towards USD, which on its turn, with time lag, caused decrease of the volume of import and the lack of the foreign currency inflow is balancing by the decline of foreign currency outflow. As a result, further depreciation of the GEL exchange rate towards USD is not expected due to the past external shocks.

|

||

|

Source: National Bank of Georgia

|

||

|

|

||

|

|

||

|

||

Source: National Bank of Georgia

Source: National Bank of Georgia Source: Georgian National Tourism Administration

Source: Georgian National Tourism Administration Source: GeoStat

Source: GeoStat Source: Ministry of Finance of Georgia

Source: Ministry of Finance of Georgia