Issue 63: State Budget Compliance – 2015

|

State Budget Compliance – 2015

Issue #63 / 28.12.2015

|

||

|

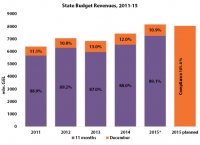

According to the preliminary data of 2015, state budget revenues as well as state budget expenditures will be complied. Specifically, state budget revenues are expected to be executed by 101.4%, while budget expenditures will reach 99.5% of the planned level. In 2015, compared to the previous year, spending from the state budget was more balanced which reduced the negative effect of the fiscal policy on exchange rate and inflation in the fourth quarter.

|

||

|

|

In January-November 2015, state budget revenues (7 270 mln. GEL) have been increased compared to the same period in the last year (11.1%; 725.5 mln. GEL). In total, budget revenues reached to 90.3% of the planned indicator and comprised 8 085 mln. GEL. Among them, tax revenues were complianed by 90.1%, grants – 97.0% and other revenues only by 90.5%.

Based on the extrapolation of the previous years’ dynamics and in case of the most conservative forecast (meaning that, in December 2015 will be mobilized exactly the same amount of revenues as in previous year (889.8 mln. GEL), budget revenues will be executed approximately by 101.4 %.

|

|

|

|

|

|

| Source: Ministry of Finance of Georgia State Treasury

In January-November 2015, state budget tax revenues have been increased (10.9%; 665.6 mln. GEL), compared to the corresponding indicator in the last year. In total, budget tax revenues reached to 90.1% of the planned indicator. Assuming that in December 2015 tax revenues will be mobilized to the same volume as in the last year (736.7 mln. GEL), budget tax revenues will be executed by 100%. The revenues from VAT have been also increased (6.7%; 200.7 mln. GEL). In January-November 2015, the revenues from VAT comprised 90.8% of the annual planned indicator. Taking into the consideration the accumulation of tax revenues in December 2014 (300 mln. GEL), budget tax revenues will be executed by 99.3% in 2015.

|

||

|

|

|

|

|

Source: Ministry of Finance of Georgia In January-November 2015, state budget expenditures ( 7 211 mln. GEL) have been increased compared to the same period last year (11.3%; 729.5mln. GEL). In total, budget expenditures reached to 88.9 % of the planned indicator and comprised 8 110 mln. GEL. Among them, expenditures on wages were realized by 90.0%, on goods and services – 86.0%, on percentages – 90. 5%, on subsidies – 95.7%, on grants – 88.5 %, on social protection – 91.2% and on the other expenditures by 86.5%. According to the extrapolation of the last years’ dynamics, we can assume that state budget expenditures will be realized approximately by 99.5%. Hence, the non-used amount of expenditures will comprise about 50 mln. GEL. In January-November 2015, the expenses on social protection have been increased (10.1%; 233.1 mln. GEL) and have been already spent 91.2% of the annual planned indicator. According to the dynamics of previous years’, the expenses on social protection will be executed around by 99.5%.

|

||

|

In 2015, the compliance of budget expenditures should not be a problem. But along with execution of budget expenditures, the balanced budget spending is also very important across the year. In the fourth quarter of 2015, 9.4% of annual budget expenditures will be spent, while 10.1% of budget expenditures were spent in the corresponding period of the previous year. Therefore, in the fourth quarter of 2015, the negative effect of the fiscal policy on exchange rate and inflation will be reduced.

|

Source: Ministry of Finance of Georgia

|

|

|

Source: National Bank of Georgia

|

||

|

|

||

|

|

||

|

||

Source: Ministry of Finance of Georgia

Source: Ministry of Finance of Georgia