Issue 18: Tax Revenues – 2013

|

Tax Revenues – 2013

ISSUE #18 / 04.02.2014

|

||||

|

The completion rate of state budget in 2013 is 91%.Correspondingly, there is the lack of 608.9 mln GEL in state budget.

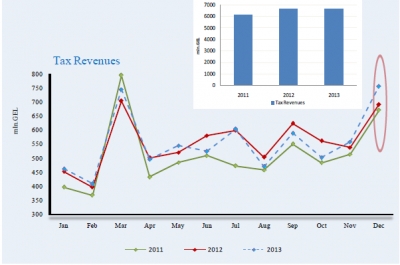

In 2013 Budget revenue decreased (-2.1%) compared to 2012. Tax Revenue (-0.2%) as well as grants (-23.3%) and other revenues (-13.3%) also decreased.

Based on the preliminary data, the indicator of Tax burden in 2013 (tax revenues/GDP) (24.8%) reduced in comparison with the corresponding indicator for 2012 (25.5%).

In 2013, the total revenue from VAT and Income taxes is 4,782.3 mln. GEL. Taking into account GDP growth (3.1%) , which is based on the turnover of VAT payer enterprises) and inflation rates (-0.5%) in the mentioned period, the total revenue from VAT and Income taxes should have been 4,928.8 mln. GEL. The volume of import increased slightly (0.4%), thus this change would not have large effect on the change of VAT revenue. This indicates lack of 146.8 mln. GEL (4,928.8 – 4782.3 =146.8 mln.GEL).

|

||||

|

In 2013, tax revenues decreased (-0.2%) in compar-ison with 2012 .

In 2013 the revenues from income (9.6%), property (0.3%) and excise (9.5%) taxes increased, while the revenues from VAT (-6.3%), profit (-5.2%) and im-port (-0.8%) taxes declined.

|

|

|

||

|

|

||||

|

||||

|

It is noteworthy, that in 2013 the VAT decreased (-6.3%), while GDP grew (3.1%) 1 .

This can be ex-plained by the growth of those sectors of GDP, the production of which are not fully taxed by VAT (e.i agriculture,financial activity,education), also by the growth of export (it is exempt from VAT) or may be tax collection was not properly administered.

1 – Forecast of GDP growth by GEOSTAT, based on the VAT payer enterprises turnover, fiscal and monetary indicators.

|

||||

|

|

||||

|

VAT revenue in December 2013 is determined based on the turnover of the VAT payer enterprises in November 2013, as they pay VAT by the 15th day of the next month and also based on the volume of import, which is taxed by VAT.

In November 2013, the turnover of the VAT payer enterprises increased (15.5%) the volume of import increased (21%) in December 2013. Accordingly, the revenue from VAT increased (6.5%) in Decem-ber 2013, but the growth rate of the revenue from VAT is less than the growth rate of the VAT enter-prises turnover and the volume of import.

|

|

|

||

|

||||

|

In December 2013, the revenue from income tax increased (12%) in comparison with the December 2012.

n 2013 income tax revenue grew (9.6%) in com-parison with the corresponding indicator in 2012, which is due to the onetime payment in March 2013.

|

||||

|

|

|

|||

|

||||

|

||||