Issue 57: Real GDP and FDI – I-II Quarters, 2015

|

Real GDP and FDI – I-II Quarters, 2015

Issue #57 / 09.10.2015

|

||

|

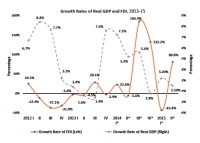

During the first half of 2015, the real Gross Domestic Product (GDP) of Georgia increased by 2.8% (208.2 mln GEL) compared to the corresponding period in 2014. In this period, the volume of Foreign Direct Investment (FDI), an important source of long-term economic growth, in Georgia amounted to US$530 mln.

|

||

|

|

During the first half of 2015, compared to the corresponding period in 2014, real GDP increased by 2.8%. During the first quarter of 2015, the real GDP Growth rate was 3.2% and in the second quarter it dipped to 2.5%. In the first two quarters of 2015, FDI increased by 4.8% compared to the corresponding period in 2014. In contrast to the indicator of real GDP, during the first quarter of 2015, the indicator of FDI declined by 43.3%, while during the second quarter it showed significant growth, reaching 80.8% which should have a positive impact on future GDP growth.

|

|

|

|

||

|

Source: GeoStat

|

|

|

|

During the first half of 2015, the real GDP was contributed to by the following sectors: industry (19.6%), transport and communication (19.2%), trade (14.7%), agriculture (10.1%), construction (9.9%), financial intermediation (5.0%), health (4.3%), real estate (4.1%), hotels and restaurants (3.9%), education (3.5%). In the mentioned period, the structure of real GDP is similar to the corresponding period of 2014. In this period, real growth was recorded in all sectors except industry (-0.6%) and trade (-0.9%), which have the first (19.6%) and third (14.7%) largest shares in formation of the real GDP. The quickest growing economic sectors during the first half of 2015 were construction (15.7%), financial intermediation (9.7%) and hotels and restaurants (7.9%).

|

||

|

|

Source: GeoStat

|

|

|

Given that during the first half of 2015, 67% of FDI (US$353.7 mln) flowed into the transport and communication sector, this sector is quite clearly the most popular among foreign investors. A similar scenario was evident during the corresponding period in 2014, where the highest flow of FDI was into the transport and communication sector, but its share of overall FDI (38.5%), as well as its volume (US$194.6 mln) was half the corresponding indicator in 2015. In the first half of 2014, 20.1% (US$101.5 mln) of FDI flowed into the energy sector, while in the corresponding period of 2015 this indicator declined (-16.3% point) significantly and amounted to 3.7% (US$19.9 mln). In this period, compared to the first half of 2014, the volume of FDI flows increased significantly in the following sectors: transport and communication (81.8%), construction (63.8%) and financial intermediates (2 times), while the manufacturing sector declined (-70.3%) in this regard.

|

||

|

Source: GeoStat

|

Source: GeoStat

|

|

|

During the first half of 2015, the top five investors by country in Georgia are: Azerbaijan (41.4%; US$219.3 mln), Netherlands (16.9%; US$89.3 mln), Turkey (12.7%; US$67.5mln), United Kingdom (8.4%; US$44.5 mln) and Luxembourg (6.0%; US$31.8 mln). This structure differs from the FDI structure in the corresponding period of 2014. In 2014, among the top five foreign investors were Russia (8.6%, US$43.4 mln), while the United Kingdom was not among them. In this period, the volume of FDI increased from the following countries: Azerbaijan (54.4%), Turkey (48.0%) and United Kingdom (132.0%), while FDI decreased from Netherlands (-51.7%) and Luxembourg (-54.5%) compared to the corresponding period in 2014.

|

||

|

|

||

|

||

Source: GeoStat

Source: GeoStat

Source: GeoStat

Source: GeoStat Source: GeoStat

Source: GeoStat