Issue 73: Analysis of the External Factors Affecting on GEL Exchange Rate

|

Analisis of the External Factors Affecting on GEL Exchange rate

Issue #73 / 15.06.2016

|

||

|

On 15 June 2016, the value of 1 USD is 2.132 GEL, which is 17.2% lower compared to the highest indicator of 2016 (2.498 GEL) so far. This issue reviews the dynamics of the key indicators, which maintain the inflow and outflow of foreign currencies in Georgia, which have a major role in the calculation of the exchange rate. These indicators are as follows: international trade (export and import), remittances, visitors in Georgia, Foreign Direct Investments (FDI) and local loans denominated in the foreign currencies and their service costs.

|

||

|

|

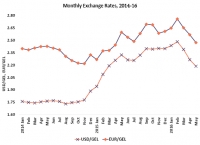

In 2015, the GEL exchange rate against both the USD and EUR declined. From 1 January 2015 to 1 January 2016, the GEL exchange rate against the USD depreciated by 27%, while the GEL exchange rate against the EUR depreciated by 14%. In 2016, the devaluation continued and on 28 January, 1 USD reached its peak value against the GEL (2.4989 GEL). From March 2016, the GEL began to appreciate and in May 2016 the GEL exchange rate against the USD appreciated by 0.09 points (3.8%) compared to the previous month, while compared to May 2015 it appreciated by 0.14 points (5.9%). A similar trend was visible in the GEL exchange rate against the EUR. On 13 March 2016, the maximal value of 1 EUR amounted to 2.8003 GEL, after which it started to depreciate. In May 2016, the GEL exchange rate against the EUR appreciated compared to the previous month by 0.14 points (5.6%), while compared to May 2015 it rose by 0.13 points (4.8%).

|

|

|

|

||

|

Based on preliminary data, during the first quarter of 2016, compared to the corresponding period in 2015, the volume of registered export of goods declined by 11.7% (80.6 mln USD), while the import of goods declined by 12.6% (295.8 mln USD)*, while the trade balance improved by 215.2 mln USD (13%).

* This indicator does not include medicaments for hepatitis C, which were given as a present from Ireland and Canada to the country. If we count the corresponding value (628.2 mln USD) as a part of imports, then in January-April 2016 the volume of imports was 2,679 USD and it has increased by 14.2% compared to the corresponding indicator in 2015. Accordingly, the trade balance deteriorated by 413 mln USD (25%).

|

|

|

|

|

In January-May 2016, the volume of remittances to Georgia amounted to 424.8 mln USD, which is 3% lower compared to the corresponding indicator in 2015. Of this figure, 32.4% of remittances flowed from Russia, 11.7% were from Greece, 11.3% came from Italy, 10.8% came from the USA, 7.4% came from Turkey and 26.4% was from a combination of several other countries. Money transfers declined mostly from Russia (-16%), from Greece (-28%) and from Azerbaijan (-28%), while this indicator increased from the USA (19%), from Israel (78%), from Italy (9%) and from Iraq (3-times).

|

|

|

An important source of foreign currency inflow to the country is number of visitors (tourism). In the period January-May 2016, 2,051,518 individuals visited Georgia, which exceeds the indicator of the previous year by 10.5% (215,973 individuals). In 2015, the volume of service export was 3,133 mln USD, which exceeds the corresponding indicator of the previous year by 3.8% (114.7 mln USD).

|

Source: Georgian National Tourism Administration |

|

Source: GeoStat Source: GeoStat |

Based on preliminary data, in the first quarter of 2016, the volume of FDI amounted to 376.4 mln USD, which exceeds the indicator of the corresponding period in 2015 by 103.2%.

|

|

|

An additional source of foreign currency inflow on the market is the volume of the loans denominated in the foreign currencies issued by commercial banks. In the short run, the growth of this indicator contributes to the strengthening of the GEL, while the growth in the volume of loans services provides the GEL’s devaluation.

In Georgia, from February 2015 the volume of loans denominated in foreign currencies issued by commercial banks declined month-on-month. The number of loan contracts also declined, while during this period the volume of loans services decreased, which triggered a reduction in demand for foreign currencies.

|

Source: National Bank of Georgia Source: National Bank of Georgia |

|

|

Source: Ministry of Finance of Georgia Forecasted *

|

||

Source: National Bank of Georgia

Source: National Bank of Georgia