Issue 122: Banking Sector in Georgia (2017-2020)

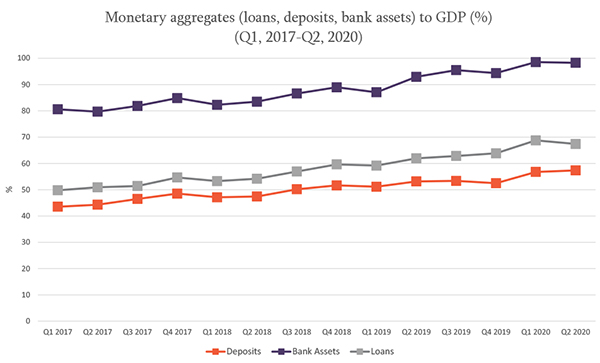

- By the end of the second quarter of 2020, loans and deposits, expressed as a percentage of GDP, increased by 3.6 and 4.9 percentage points, respectively, compared to the beginning of the year;

- By the end of the second quarter of 2020, bank assets, expressed as a percentage of GDP, increased to 98.4%;

- By the end of July of 2020, the volume of loans was increased by 19%, compared to July of 2019;

- The average interest rates on loans in January-July of 2020 denominated in national currencies were 0.9 percentage points higher than in January-July of 2019, while the average interest rates on loans denominated in foreign currencies were 0.8 percentage points less;

- By the end of July of 2020, the volume of deposits in Georgia was increased by 21%, compared to July of 2019;

- The average interest rates on deposits in January-July of 2020 denominated in national currencies were 1.2 percentage points higher than in January-July of 2019, while the average interest rates on deposits denominated in foreign currencies were 0.4 percentage points less;

- In January-July of 2020 trade had the highest share of total loans with 29.5%;

- In January-July of 2020, share of construction in total loans increased by 3.6 percentage points, while share of financial intermediation decreased by 8.2 percentage points, compared to the corresponding period of 2019;

- According to the World Bank, Georgia’s ratio of non-performing loans to total loans decreased in 2019, compared to 2018, by 0.8 percentage points and dropped to 1.9%;

- By the end of July of 2020 the rates of dollarization on loans and deposits were increased by 0.3 and 8 percentage points, compared to the corresponding period of 2019. The rates rose to 56.9% and 61.3%, respectively.