Issue 86: Banking Sector – I – III Quarters, 2016

|

Banking Sector – I – III Quarters, 2016

Issue #86/ 11.01.2017

|

||

|

Analysis of January – November 2016, compared to the corresponding period in 2015:

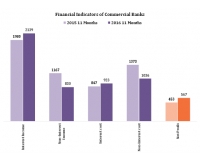

• Net profit of commercial banks increased by 25.1% (114 mln GEL) and amounted to 567 mln GEL.

|

||

|

Source: National Bank of Georgia

|

|

Source: National Bank of Georgia

|

|

According to data for November 2016, there are 16 banks in the Georgian banking sector. After the merger of TBC Bank and Republic Bank, 68% of total assets in the banking industry are now distributed among the two largest banks – TBC Bank (35%) and Bank of Georgia (33%). Liberty Bank (6%) and VTB Bank (5%) are also in the top largest banks.

In January – November 2016, the net profit of commercial banks amounted to 567 mln GEL which is 25.1% higher (114 mln GEL) compared to the corresponding period in 2015. It should be noted that interest income (8.0%, 159 mln GEL) as well as interest cost (8.9%, 75 mln GEL) increased. Meanwhile, non-interest income (-28.9%, -337 mln GEL) and non-interest cost (-24.5%, -337 mln GEL) significantly decreased. The reduction of non-interest income and cost is mostly due to revaluation of loans and deposits.

|

||

|

|

Source: National Bank of Georgia

|

|

|

According to data for November 2016, compared to the corresponding period in 2015, the volume of deposits* increased significantly (9.4%). There was an increase in the volume of deposits denominated in national currency (6.2%) as well as in foreign currency (10.9%).

Based on data for November 2016, compared to the corresponding period in 2015, the volume of loans** increased significantly (7.9%). There was an increase in the volume of loans denominated in national currency (9.2%) as well as in foreign currency (7.2%).

* For foreign currency, the volume of deposits is adjusted according to the exchange rate. The base year is the corresponding period in the previous year.

** For foreign currency, the volume of deposits is adjusted according to the exchange rate. The base year is the corresponding period in the previous year.

|

||

|

Source: National Bank of Georgia

|

Loans and deposits denominated in the national currency have been characterized by more volatility. In November 2016, the difference between interest rates on loans denominated in national and foreign currency reduced (0.4 percentage points) and amounted to 9.3%. The average interest rate on loans denominated in national currency was 18.1% while in foreign currency it equalled 8.8%.

In November 2016, the difference between interest rates on deposits denominated in national and foreign currency reduced (-3.1 percentage points) and amounted to 4.4%. The average interest rate on deposits denominated in national currency was 7.8% while in foreign currency it equalled 3.4%.

|

|

|

|

||

|

Source: National Bank of Georgia

|

|

Source: National Bank of Georgia

|

|

Based on data for November 2016, the structure of loans by economic sector changed significantly. The share of trade (-1.6 percentage points) and industry (-2.2 percentage points) in total loans reduced. Meanwhile, the share of construction (2.8 percentage points), financial intermediation (2.5 percentage points) and hotels and restaurants (3.0 percentage points) in total loans increased.

Based on data for November 2016, the volume of non-performing loans increased (9.5%, 119 mln GEL) while the share of non-performing loans in total loans decreased (-0.3 percentage points) and amounted to 7.7%. This was mostly due to depreciation of the GEL. In this period, reserves covered 51% of total non-performing loans.

|

||

|

Source: National Statistics Office of Georgia Forecast*

National Bank of Georgia

Ministry of Finance of Georgia

|

||