Issue 54: The Impact of Possible Russian Embargo on Georgian Exports

|

The Impact of Possible Russian Embargo on Georgian Exports

Issue #54 / 26.08.2015

|

||

|

In 2014, the breakdown of Georgian exports by country noticeably differed from 2005 (before Russian embargo). In 2005, Russia was the largest market for Georgian exports and the share of Russia with a share of 17.8%. In 2014, the largest trading partner for Georgia in terms of exports is Azerbaijan (19% of total export), followed by Armenia (10%) and Russia now sits third having reduced to 9.6% (US $274.7 mln).

It should be noted that in 2005 Georgia exported to 93 countries, while by 2014 the number of countries had increased to 120.

From 2005 to 2014, the annual average growth rate of Georgian export (excluding Russian market) was 18.8% and exports increased by US $1 874.5 mln, in total.

The dependence on the Russian market reduced and the market for export has become more diversified which in some ways offsets the impact of external economic factors (embargo) on Georgian exports.

|

||

|

Source: comtrade.un.org

|

Source: comtrade.un.org

|

|

|

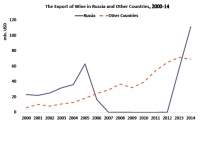

In 2014, the breakdown of Georgian wine exports by country noticeably differed from 2005 (before Russian embargo). The share of the Russian market in Georgian wine exports decreased significantly (by 15 percent). In 2005, the share was 77% while in 2014 it had decreased to 62%.

Alongside the diversification of the market for Georgian wine export, from 2005 to 2014 the annual average growth rate of Georgian wine export (excluding Russian market) was 19.7% and export increased by US $50.9 mln, in total.

|

||

|

Source: comtrade.un.org

|

Source: comtrade.un.org

|

|

|

|

|

|

|

In 2014, the breakdown of Georgian spirit beverages export by country noticeably differed from 2005 (before Russian embargo). The share of the Russian market in Georgian spirit beverages export decreased significantly (by 46 percent). In 2005, the share was 64% while in 2014 it had reduced to 18%.

Alongside the diversification of the market for Georgian spirit beverages export, from 2005 to 2014, the annual average growth rate of Georgian spirit beverages export (excluding Russian market) was 19.7% and export increased by US $67.2 mln, in total.

|

||

|

Source: comtrade.un.org

|

Source: comtrade.un.org

|

|

|

In 2014, the breakdown of Georgian mineral and aerated waters export by country noticeably differed from 2005 (before Russian embargo). The share of the Russian market in Georgian mineral and aerated waters export decreased significantly (by 25 percent). In 2005, the share was 73% while in 2014 it had decreased to 48%.

Alongside the diversification of the market for Georgian mineral and aerated waters export, from 2005 to 2014, the annual average growth rate of Georgian mineral and aerated waters export (excluding Russian market) was 32.2% and export increased by US $61.9 mln, in total.

|

||

|

Source: comtrade.un.org

|

Source: comtrade.un.org

|

|

|

In 2014, the breakdown of Georgian export (excluding wines, spirit beverages, mineral and aerated waters by country noticeably differed from 2005 (before Russian embargo). The share of the Russian market in Georgian exports of these products decreased (by 4 percent). In 2005, the share was 7% while in 2014 it was only 3%.

Alongside the diversification of the market for Georgian exports, from 2005 to 2014, the annual average growth rate of Georgian export of these products (excluding Russian market) was 18.3% and export increased by US $694.4 mln, in total.

|

||

|

|

||

|

||