Issue 17: Tax Revenues – January – November 2013

|

Tax Revenues – January-November 2013

ISSUE #17 / 23.01.2014

|

|||

|

The completion rate of state budget in 2013 is 90.9%.Correspondingly, there is the lack of 632.3 mln. GEL in state budget1.

During the three quarter of 2013, the indicator of Tax burden (tax revenues/GDP) (25.3%) has not changed much in comparison with the corresponding indicator for 2012 (25.7%).

In November 22013, tax revenues increased in comparison with the November 2012 (3.6%). Revenues from Income, Import and Property taxes increased (19.4%; 17.6%; 11.4%) and the revenues from VAT, Profit and Excise taxes (-2.2%; -20.6%; -0.3%) declined.

In the period of January-November 2013, the total revenue from VAT and Income taxes is 4242.3 mln. GEL. Taking into account GDP growth (2.6%) , which is based on the turnover of VAT payer enterprises) and inflation rates (-0.7%) in the men-tioned period, the total revenue from VAT and Income taxes should have been 4390.9 mln. GEL. The volume of import decreased (-1.53%), which should cause decrease of VAT revenue approximately by 20 mln GEL. This indicates lack of 128.6 mln.GEL (4390.9-4242.3-20)=128.6mln.GEL).

1.Operative data

2.The data of December will be published on 31th of January.

|

|||

|

In November 2013, the volume of Tax Revenues in-creased in comparison with the same indicator in Oc-tober 2013 (11.1%), as well as in comparison with the indicator in November 2012 (3.6%).

In the period of January-November 2013, monthly dynamics of tax revenues did not change much, but the total volume of tax revenues decreased (-1.3%) in comparison with the indicator of the corresponding period in 2012.

|

|

|

|

|

|

|||

|

|||

|

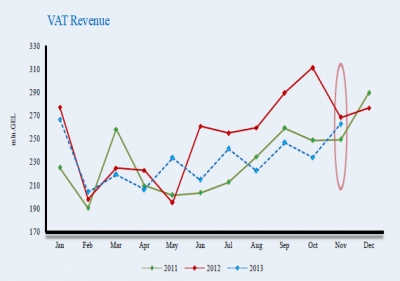

In November 2013, the volume of VAT revenue de-creased in comparison with the indicator of November 2012 (-2.1%).

It is noteworthy, that in the period of January-Novem-ber 2013 the VAT decreased (-7.6%), while GDP grew (2.6%) 1 . This can be explained by the growth of those sec-tors of GDP, the production of which are not fully taxed by VAT (e.i agriculture,financial activity,education), also by the growth of export (it is exempt from VAT); by decrease of import (it is not included in GDP but is the base of VAT or may be tax collection was not properly administered.

1. Forecast of GDP growth by GEOSTAT, based on the VAT payer enterprises turnover, fiscal and monetary indicators.

|

|||

|

|

|||

|

It is considerable, that the turnover of the VAT payer enter-prises increased (5.7%) in October 2013, the volume of im-port increased (22.1%) in November 2013, but the revenue from VAT decreased in November 2013 (-2.1%).

VAT revenue in November 2013 is determined based on the turnover of the VAT payer enterprises in October 2013, as they pay VAT by the 15th day of the next month. And also based on the volume of import, which is taxed by VAT. As both of these indicators increased, it’s interesting why corresponding indicator of VAT decreased.

|

|

|

|

|

|||

|

In November 2013, income tax revenue increased in com-parison with October 2013 (0.1%), as well as in comparison with November 2012 (19%).

In the period of January-November 2013, income tax rev-enue grew (9.2%) in comparison with the corresponding indicator in 2012, which is due to the onetime payment in March 2013.

|

|||

|

|

|||

|

|||

|

|||