Issue 31: Tax Revenue – January-September 2014

|

Tax Revenues – January-September 2014

ISSUE #31/ 31.10.2014

|

||

|

In September 2014, the volume of budget tax revenues exceeds (17.0%; 96.6 mln. Gel) the corresponding indicator in September 2013 and reaches 665.9 mln. GEL. Revenues increase from: value-added tax (VAT) (23.0%), profit tax (22.3%), personal income tax (14.2%) and import tax (13.2%). Revenue from the excise tax decreases (-1.4%).

In September 2014, the share of the tax revenues in the budget revenues increases (1.9 percentage point) compared to September 2013 and reaches 94.8%. The structure of budget tax revenues is the following: VAT (45.6%), personal income (24.0%), profit (17.4%), excise (11.5%), import (1.3%) and other unclassified taxes (0.2%).

|

||

| State Budget Expenditures, January – September 2014 | State Budget Revenues, January – September 2014 | |

|

|

|

|

Source: Ministry of Finance of Georgia

|

||

|

In the period, January -September 2014, the volume of the state budget revenues exceeds (9.1%; 446.7 mln. GEL) the corresponding indicator in 2013 and reaches 5 362.6 mln. GEL.

In this period, tax revenues (10.0%; 457.9 mln. GEL) and grants (4.9%; 5.9 mln. Gel) increase; however, the revenues from other receipts decline. This includes interests, dividends, rents, realization of goods and services, licence and permit fees (-8.0%; -17.1 mln. GEL).

Moreover, during January- September 2014, budget revenues are 73.3% of the planned budget revenues for 2014. This exceeds the indicator of 2013 (66.2%) over the same period.

The share of tax revenues in the budget revenues is 94.0% in this period. The structure of tax revenues is the following: value-added (48.1%), personal income (25.3%), profit (13.1%), excise (11.8%), import (1.5%) and other unclassified taxes (0.2%).

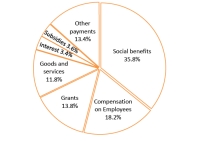

During January-September 2014, state budget expenditures exceed (18.4%; 808.9 mln. GEL) the indicator in 2013 and reached 5 209.1 mln. GEL. In this period all the components of the state budget expenditures increased, the highest growth is in – social benefits (27.8%, 406.1 mln. GEL) and expenditures on goods and services (23.2%; 115.5 mln. GEL).

|

||

| Dynamics of VAT Revenue | ||

|

In the first three quarters of 2014, revenue from VAT exceeds (17.8%; 365.9 mln. Gel) the indicator of the same period in 2013.

In addition, in September 2014, revenue from VAT exceeds (23.0%; 56.7 mln. GEL) the indicator of September 2013.

The increase of revenue from VAT is mainly due to the following factors:

|

|

|

Source: Ministry of Finance of Georgia

|

||

|

In the first three quarters of 2014, the revenue from personal income tax increase (1.4%; 18.1 mln. GEL) compared to the same period in 2013.

Furthermore, in September 2014, revenue from personal income tax exceeds (14.2%; 19.9 mln. GEL) the indicator of September 2013.

|

Dynamics of Income Tax Revenue | |

|

||

| Source: Ministry of Finance of Georgia | ||

| Dynamics of Excise tax revenue |

|

Dynamics of Import Tax Revenue |

|

|

|

|

Source: Ministry of Finance of Georgia

|

Source: Ministry of Finance of Georgia

|

|

|

In the first three quarters of 2014, the revenue from excise tax increase (9.2%; 50.1 mln. GEL) compared to the indicator of 2013.

Moreover, in September 2014, the revenue from excise tax decrease (-1.4%; -1.1 mln. GEL) compared to the indicator of September. This is mainly due to a decline in raw tobacco imports (-68.8%; -397.4 thousand USD) compared to September 2013.

|

In the first three quarters of 2014, the revenue from import tax increase (14.0%; 9.0 mln. GEL) compared to the same period in 2013.

In addition, in September 2014, the revenue from import tax exceeds (13.2%, 1.0 mln. GEL) the indicator of September 2013.

In September 2014, the revenue from the import tax increases due to a growth in volume of import (5.4%; 37.2 mln. USD) compared to the indicator of 2013. Besides this, the exchange rate declines by 5% compared to September 2013, which also affects import tax revenue.

|

|

|

||

|

||