Issue 40: Banking Sector – 2014

|

Banking Sector – 2014

Isuue #40 / 20.02.2015

|

||

|

In 2014, the volume of the deposits increased (20.8%) compared to 2013. In this period the volume of the loans to the national economy also increased (23.4%).

In 2014, the share of the deposits denominated in the foreign currency (60.2%) remains the same compared to 2013, which points that the level of dollarization did not change. In this period, the share of the loans denominated in foreign currency is 60.8%, which is lower (-1.2% point) than the indicator of 2013.

In this period, the profit of the commercial banks increased (22%; 85.8 mln. GEL) compared to 2013.

|

||

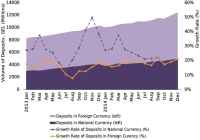

| The Volume of the Deposits Denominated in the National and Foreign Currencies, 2013-14 | ||

|

Source: National Bank of Georgia

|

In 2014, the total volume of the deposits denominated in the national and foreign currencies is 12 425.5 mln.GEL, which exceeds (20.8%) the corresponding indicator in 2013. The volume of the deposits denominated in GEL as well as in foreign currency increased by almost the same rate(20.7%, 849.5 mln. GEL; 20.8%, 1 288.0 mln. GEL respectively). In case of the growth of the deposits denominated in the foreign currency, the factor of the change of the currency exchange rate should also be taken into consideration.

In this period, the share of the deposits denominated in the foreign currency (60.2%, 7 476 .5 mln.GEL) still exceeds the share of the deposits denominated in the national currency (39.8%, 4 949 mln. GEL). It should be noted, that the share of the deposits denominated in the foreign currency remains the same compared to 2013, which points that the level of the dollarization did not change.

The structure of the deposits denominated in the foreign currency is the following: USD (81.57%), Euro (15.8%), Pound Sterling (2.1%), Swiss Franc (0.3%), Russian Rouble (0.03%) and others (0.2%).

In 2014, the avarage interest rate on the deposits denominated in the foreign currency is 5.2 %, which is lower (-1.8 percentage points) than the indicator in 2013 (7%). In this period, the avarage interest rate on the deposits denominated in the national currency also decreased (-0.9% point) and equals 7.6%.

|

|

|

|

||

| The Dyanamics and Growth Rate of the Loans to the National Economy | ||

|

In 2014, the volume of the loans to the economy is 13 080 mln. GEL, which exceeds (23.7 %, 2 510.9 mln. GEL) the corresponding indicator in 2013. The share of the loans denominated in the foreign currency is 60.8% (7 954 mln. GEL), correspondingly the share of the loans denominated in GEL is 39.2% (5 126 mln. GEL) of total loans.

In 2014, the avarage interest rate on the loans denominated in the foreign currency is 11.9%, which is lower (-1.6 percentage points) than the indicator in 2013. In this period, the interest rate on the loans denominated in the national currency also decreased (-2.5 percentage points) and equals 18.2%.

In 2014, 51% of the total loans is the loans to the legal entities, while 49% of the total loans is the loans to the individuals. 42% of the loans to the individuals is denominated in the foreign currency, while 58% of the loans to the individuals is denominated in the national currency. The structure of the loans to the legal entities differs from the structure of the loans to the individuals. 23% of the loans to the legal entities is denominated in GEL, while 77% of it is denominated in the foreign currency.

In 2014, the volume of the loans to the individuals as well as the loans to the legal entities increased (30%, 1 414.6 mln.GEL; 17%, 948.7 mln.GEL) compared to 2013.

|

|

|

|

|

||

| The Loans by the Sectors of the Economy, 2013-2014 | ||

|

Source: National Bank of Georgia

Geostat

|

In the first three quarters of 2014, construction (1.2%), trade (1.1%) and industry (1.1%) sectors have the largest contribution to the GDP growth (5.9%) of the corresponding period.

In 2014, the largest sectors by the volume of the loans to the economy are trade (30.7%), industry (25.0%), transactions in real estates, research and commercial activities (7.0%) and construction (6.7%).

In 2014, the volume of the loans to the industry (68%), agriculture (83%), healthcare and social services (60%) sectors, as well as the loans to the transactions in real estates, research and commercial activities (2 times) increased, while the loans to trade (-20%) and construction (-3%) sectors decreased.

|

|

| The Loans to the Househoulds, 2013-2014 | ||

|

In 2014, the volume of the loans to the households increased (30.5%, 1 175 mln. GEL) compared to 2013.

The largest share in the household loans have consumer loans (36.5%) and the loans secured by the real estates (45.7%). 82.3% of the consumer loans is denominated in GEL and 17.7% of it is denominated in the foreign currency. As to the loans secured by the real estates, 21.5% of it is denominated in GEL, while 78.5% of it is denominated in the foreign currency.

In 2014, the consumer loans as well as the loans secured by real estate increased (23.8%; 429.2 mln.GEL; 36.4%; 745.9 mln.GEL) compared to 2013.

|

Source: National Bank of Georgia

|

|

| Non-Performing Loans and its Share in the Total Loans, 2009-14 | ||

|

Source: National Bank of Georgia

|

The share of the non-performing loans as well as the share of the overdue loans to the total loans determine the quality of the credit portfolio of the comercial banks.

In 2014, the volume of the non-performing loans (NPL) increased (25.0%,197.4 mln. GEL) compared to 2013, but as the total loans also increased, the share of NPL (7.6%) in total loans does not change much (0.1 percentage points). In this period the reserves of NPL covers the 48.1% of the non-performing loans.

In 2014, the volume of the overdue loans also increased (8.9%), but the share of this indicator in the total loans decreased (-0.2 percentace points) compared to 2013 and equals 1.9%.

|

|

|

The Income and the Expenses of the Commercial Banks, 2007-14

|

||

|

In 2014, the profit of the commercial banks increased (22.0%, 85.8 mln. GEL) compared to 2013 and amounts 474.8 mln. GEL.

In this period, both, the revenue as well as the expenses of the commercial banks increased (10.8%, 261.7 mln. GEL; 6.9%; 137.3 mln. GEL respectively).

It should be noted, that in 2014, the commercial banks’ net gains from the currency conversion operations is 118.1 mln. GEL, which is less (-10.4%; -13.6 mln. GEL) than the corresponding indicator in 2013. However, the net gain in December exceeds (three times, 17.5 mln. GEL) to the indicator of November 2014 and equals to 23 mln.GEL.

In 2014, the return on equity (ROE) is 14.8%, which is 0.1 percentage points lower than the same indicator in 2013 (14.9%).

|

Source: National Bank of Georgia

|

|

|

|

||

|

||

Source: National Bank of Georgia

Source: National Bank of Georgia