Issue 61: Financial Soundness Indicators of the Commercial Banks- October, 2015

|

Financial Soundness Indicators of the Commercial Banks – October, 2015

Issue #61 / 04.12.2015

|

||

|

In October 2015, considering the effect of foreign exchange rate, the volume of deposits increased by 5.9%, while the volume of loans to the national economy increased by 10.9% compared to the corresponding periods in 2014. For the period of January-October 2015, the key indicators, which determine the financial sustainability of the commercial banks, are stable.

|

||

|

|

|

|

|

Source: National Bank of Georgia

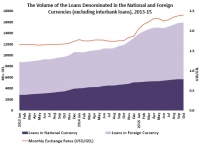

In October 2015, the volume of loans to the national economy (excluding interbank loans) amounted to 15 892.8 mln. GEL, which exceeds by 34.0% the corresponding indicator in October 2014. The volume of loans denominated in national currency increased by 19.9%. The volume of loans denominated in foreign currency increased by 43.4%, but considering the effect of the currency exchange rate, the growth of this indicator is only 4.9%. The share of non-performing loans among total loans is an important indicator for measuring financial sustainability in the country. In October 2015, the volume of non-performing loans increased by 23.0% compared to the corresponding period of the previous year and amounted to 1 250.2 mln. GEL, which is mainly due to the revaluation of the non-performing loans denominated in foreign currency as a result of GEL depreciation. But the share of the non-performing loans among total loans declined by 0.7% point. In this period, the reserves of non-performing loans account for 47.5% of the non-performing loans.

|

||

|

|

In October 2015, the total volume of deposits (excluding interbank deposits) was recorded at 14 874.1 mln. GEL, which exceeds by 30.2% the corresponding indicator in October 2014. Furthermore, the volume of deposits denominated in national currency declined by 2.0%. The volume of deposits denominated in foreign currency increased by 52.2%, but due to a diminished exchange rate, this growth amounted to only 11.3%. In this period, the share of deposits denominated in foreign currency increased by 10.0% point compared to the indicator of October 2014 and amounted to 69.4%. This indicates that the level of dollarization increased.

|

|

|

Regulatory capital to risk weighted assets ratio is another important indicator to measure financial sustainability. According to the international standards of banking supervision (basel III), this indicator should be no less than 12%. From 2013 to 2015, the regulatory capital to risk weighted assets ratio exceeded the threshold. In October 2015 this indicator stood at 17.4%.

|

|

|

|

|

The other important indicators of financial stability for foreign investors are the return on equity (ROE) and returns on assets (ROA). In October 2015, commercial banks’ ROE remains the same compared to the corresponding indicator of 2014 and equals 13.7%, while ROA declined by 0.3% point and amounts to 2.1%.

|

|

|

For the period of January-October 2015, the net profit of the commercial banks increased by 11.0% compared to the same period in the previous year and amounted to 399.3 mln. GEL. In this period, compared to the period of January-October 2014, the incomes of the commercial banks increased by 40.7%. Specifically, income from interest rose by 24.6% and the non-interest incomes rose by 78.0%. In this period, the commercial banks’ expenses also increased (49.3%), specifically, interest expenses rose by 25.2%, while non-interest expenses rose by 58.6%.

|

|

|

|

Source: National Bank of Georgia

|

||

|

||

Source: National Bank of Georgia

Source: National Bank of Georgia Source: National Bank of Georgia

Source: National Bank of Georgia Source: National Bank of Georgia

Source: National Bank of Georgia Source: National Bank of Georgia

Source: National Bank of Georgia