Issue 65: Foreign Direct Investment – I-III Quarters, 2015

|

Foreign Direct Investment – I-III Quarters, 2015

Issue #65 / 15.01.2016

|

||

|

According to the preliminary data, in the first three quarters of 2015, the volume of Foreign Direct Investment (FDI), an important source of economic growth, amounted to US$1019.0 mln in Georgia. In this period, the largest investors by country were Azerbaijan (38.5%), Netherlands (14.2%) and Turkey (10.8%). The highest proportion of FDI was in the transport and communications sector (56.1%), while the most attractive location for investors was still Tbilisi (78.0%).

|

||

|

|

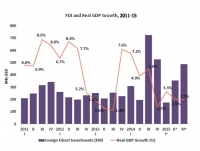

In the first three quarters of 2015, the volume of FDI declined by 17.3% compared to the corresponding period of 2014. During the first and third quarters of 2015, the indicator of FDI declined (-43.4%; -32.6%), while during the second quarter it showed significant growth (80.8%). In this period, according to the preliminary data, the average annual growth of real GDP amounted to 2.7%. In the first quarter GDP saw an increase of 3.2%, while in the second and third quarters it rose by 2.5%.

|

|

|

|

|

|

| Source: GeoStat In the first three quarters of 2015, the top five investors by country in Georgia were as follows: Azerbaijan (38.5%; $392.0 mln), Netherlands (14.2%; $144.7 mln), Turkey (10.8%; $110.4 mln), United Kingdom (8.4%; $85.7 mln) and Luxemburg (6.1%; $62.3 mln). This breakdown differs from the FDI results in the corresponding period of 2014. In 2014, the top five foreign investors included China (14.1%, $174.2 mln) and USA (13.3%, $164.1 mln), while Turkey and the United Kingdom were not among them. In this period, the volume of FDI increased from the following countries: Azerbaijan (55.3%), Turkey (64.8%) and United Kingdom (96.3%), while FDI decreased from Netherlands (-49.0%) and Luxemburg (-28.5%) compared to the corresponding period in 2014. It should be noted, that in the third quarter of 2015, the volumes of FDI from Azerbaijan and Turkey were the highest among the investments from these countries ($172.7 mln and $55.4 mln respectively).

|

||

|

|

|

|

|

Source: GeoStat

In the first three quarters of 2015, the breakdown of FDI by economic sector is as follows: transport and communications (56.1%), construction (11.0%), financial sector (10.8%), manufacturing (6.6%), hotels and restaurants (4.4%) and other sectors (11.1%). This composition differs from the FDI structure in the corresponding period of 2014. In 2014, included in the top five sectors were real estate (14.1%) and energetic (12.4%), while the financial sector and hotels and restaurants were not among them. In the first three quarters of 2015, compared to the corresponding period of 2014, the volume of FDI into the transport and communications sector increased (74.9%), thereby growing its share of overall FDI by 29.6% points. The volume of FDI in this sector is showing an increasing trend and in 2015 reached its highest level. In addition, the volume of investments into the financial sector increased significantly (29.6-fold), while the construction sector declined in this regard (-47.5%).

|

||

|

|

|

|

|

Source: GeoStat

In the first three quarters of 2015, 78.0% of FDI came to Tbilisi. This share increased by 5.7% points compared to the corresponding period in 2014, while the total volume of FDI to Tbilisi declined by 10.8%. In the first three quarters of 2015, the most popular regions, after Tbilisi, among foreign investors were: Samegrelo-Zemo Svaneti and Guria (7.4%), Adjara (7.3%) and Kvemo Kartli (4.4%). Here, compared to the first three quarters of the previous year, the volume of investments increased in Samgrelo-Zemo Svaneti and Guria (11.4%) and Kvemo Kartli (2.4%), while the inflows of FDI in Adjara declined (-26.3%).

|

||

|

Source: National Bank of Georgia

|

||

|

|

||

|

|

||

|

||

Source: GeoStat

Source: GeoStat