Issue 67: Banking Sector – 2015

|

Banking Sector – 2015

Issue #67 / 19.02.2016

|

||

|

In December 2015, compared to the same month of the previous year 2014, the volume of total deposits increased by 24.8% (3 080 mln GEL), while the volume of total loans to the national economy increased by 23.5% (3 074 mln GEL). Taking exchange rates into consideration, the growth rate of the deposits is 5.4% and the growth rate of the loans is 5.8%. In this period, the average interest rate on deposits denominated in foreign currency declined by 0.6 percentage point and on deposits denominated in the national currency increased by 1.1% percentage. Regarding loans, interest rates on loans denominated in foreign currencies declined by 1.1 percentage point and on loans denominated in GEL declined by 0.6% point. The share of the deposits denominated in foreign currencies in total deposits increased by 10.0%, while the share of the loans denominated in the foreign currencies increased by 3.7%. However, taking exchange rates into consideration, the change in these indicators are 4.5 percentage point and -2.2 percentage point, respectively. Therefore, the level of the dollarization of the deposits increased, while the level of dollarization of loans declined.

|

||

|

|

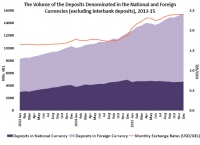

In December 2015, the volume of the total deposits, excluding interbank deposits, amounted to 15 505 mln GEL, which exceeds the indicator of 2014 by 24.8%. The volume of deposits denominated in the national currency declined by 6.1%, while the volume of the deposits denominated in foreign currencies increased by 45.4%, but taking exchange rates into consideration, the growth rate of this indicator is only 13.2%. In 2015, the average interest rate on the deposits denominated in foreign currencies was 4.6%, which is 0.6 percentage point lower than the same indicator of the previous year. In this period, the average interest rate on the deposits denominated in the national currency increased (0.1 percentage point) and equaled 7.7%.

|

|

|

In December 2015, the volume of loans issued by commercial banks (excluding interbank loans) recorded 16 154 mln GEL, which exceeds the corresponding indicator in 2014 by 23.5%. Here, the volume of the loans denominated in national currency increased by 11.8%, while the volume of the loans denominated in foreign currencies increased by 31.0%, but taking exchange rates into consideration, the growth rate of the loans denominated in foreign currencies was only 2.0%. In 2015, the average interest rate on the loans denominated in foreign currencies was 10.8%, which is 1.1 percentage point lower compared to the indicator of 2014. In this period, the average interest rate on the loans denominated in the national currency declined by 0.6 percentage point and equaled 17.6%.

|

|

|

|

|

In December 2015, the largest sectors by volume of loans to the economy are industry (12.5%), trade (11.4%) and transactions in real estate (4.0%). In this period, compared to December 2014, the volume of loans to the industrial sector (19.4%; 307.1 mln GEL) and to the transactions in real estate (36.5%; 162.3 mln GEL) increased significantly, while loans declined to trade (-11.3%; 220.8 mln GEL).

|

|

|

In 2015, the loans secured by real estate (53.8%) and consumer loans (28.6%) make up the largest share of household loans. Overall, 78.1% of the consumer loans are denominated in the national currency, while 21.9% of its are denominated in foreign currency. Loans secured by real estate have a different structure, with 79.6% denominated in foreign currencies, while 20.4% are denominated in the national currency. In December 2015, the volume of consumer loans increased by 1.7%, but taking exchange rates into consideration, this indicator declined by 3.2%. In this period, the volume of loans secured by real estate increased by 53.6%, but taking exchange rates into consideration, this indicator declined by 5.4%.

|

|

|

|

|

The quality of the credit portfolio of a commercial bank is determined by its share of non-performing loans and overdue loans in the total loans.

In December 2015, the volume of the non-performing loans (NPLs) increased by 21.5% (212.2 mln GEL) compared to the previous year and amounted to 1 200.4 mln GEL. This growth is due to the devaluation of GEL. The share of NPL in the total loans declined by 0.1 percentage point and equaled 7.5%. In this period, the reserves of NPL amounted to 49.5 % of the NPLs. In 2015, the volume of overdue loans also increased (16.1%; 40.5 mln GEL) but its share in the total loans declined (-0.1 percentage point) and equaled 1.8%.

|

|

|

In January-December 2015, the income of the commercial banks increased (28.6%; 768.5 mln GEL) compared to the corresponding period of 2014. The interest income (24.6%; 433.8 mln GEL), while non-interest income (36.3%; 334.7 mln GEL) also increased. In this period, in the category of interest income, the income from loans (22.8%; 367.8 mln GEL), from securities (51.4%; 58.8 mln GEL), from “nostro” accounts* (43.8%; 2.8 mln GEL), and there was also an increase from other sources (15.9%; 4.5 mln GEL). In the category of non-interest income, income from net gains of conversion operations (15.1%; 17.9 mln GEL) and other non-interest income, which includes dividends received, profit/loss from re-evaluation the currency resources and from property sales, increased (64.9%; 335.7 mln GEL), while the income from securities trading (4-times; 14.9 mln GEL) but there was a decline in revenue from fees and commissions (1.4%; 3.9 mln GEL). In January-December 2015, the net profit of commercial banks increased by 13.2% compared to the previous year, amounting to 537.4 mln GEL.

* Bank accounts at the corresponding bank on which interpayments are reflected.

|

|

|

|

Source: National Bank of Georgia

|

||

|

||

Source:

Source:  Source: National Bank of Georgia

Source: National Bank of Georgia Source:

Source:  Source: National Bank of Georgia

Source: National Bank of Georgia Source:

Source: