Issue 71: Tax Revenues – January-March, 2016

|

Tax Revenues – January-March, 2016

Issue #71 / 05.05.2016

|

||

|

In the first quarter of 2016:

|

||

|

|

In the first quarter of 2016, state budget revenues increased (6.3%) compared to the corresponding indicator of the previous year and amounted to 2,210 mln GEL.

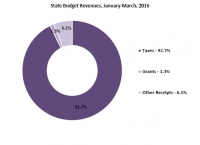

In this period, the structure of state budget revenues has remained similar to the corresponding indicator in 2015. Taxes are responsible for 92.7% of the state budget revenues, while 1.3% comes from grants, and 6.1% come from other receipts (including revenues from interests, dividends, rents, realization of goods and services, license and permit fees and transfers). Among them, revenues increased from taxes (8.4%) and other receipts (1.9%), while decreased from grants (-52.2%).

|

|

|

In the first quarter of 2016, compared to the corresponding period in the previous year, tax revenues increased in each of the three months. Specifically, in January, tax revenues increased by 1.8%, while in February they increased by 17.7% and in March they rose by 15.8%. In this period, the indicator of state budget taxes compliance compared to the annual plan is 25.7%.

|

|

|

|

|

During the first quarter of 2016, the largest source of tax revenues (35.5%) was VAT. This indicator declined by 14.2% compared to the corresponding indicator of 2015 and amounted to 728.1 mln GEL. Compared to the annual plan, the indicator of VAT revenues compliance is 19.2%.

|

|

|

In January-March 2016, 20.2% of the tax revenues come from income tax. This indicator is lower (-10.3%) than the corresponding indicator of the previous year and amounts to 412.8 mln GEL. The reduction is due to the sharp decline, which was recorded in January (-81.2%). Compared to the annual plan, the indicator of income tax revenues compliance is 19.8%.

|

Source: Ministry of Finance of Georgia |

|

Source: Ministry of Finance of Georgia |

In the first quarter of 2016, excise tax revenues represented 11.1% of the total tax revenues. Compared to the corresponding period in the previous year, excise tax revenues increased by 28.2% and amounted to 226.7 mln GEL. The growth recorded in each of the three months (January – 25.3%; February – 12.9%; March – 44.1%). The indicator of excise tax compliance is 22.4% compared to the annual plan.

|

|

|

During the first quarter of 2016, the lowest source of the tax revenues (1.2%) were the revenues from import tax. This indicator increased by 34.3% compared to the corresponding indicator of 2015 and amounted to 23.9 mln GEL. The indicator of excise tax compliance is 31.9%, compared to the annual plan.

|

Source: Ministry of Finance of Georgia |

|

|

Source: Ministry of Finance of Georgia Forecasted *

|

||

Source: Ministry of Finance of Georgia

Source: Ministry of Finance of Georgia