Issue 32: Public Debt – I-III quarters, 2014

|

Public Debt – I-III quarters, 2014

Issue #32/ 14.11.2014

|

||

|

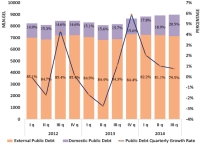

In the first three quarters of 2014, the volume of public debt increases (3.9%; 336.1 mln. GEL) compared to 2013. The volume of domestic debt increases (36.6%), while the volume of external debt declined (-2.1%).

In the first three quarters of 2014, the share of external debt in public debt is 79.5%, and the share of domestic debt in public debt is 20.5%. Government’s three largest multilateral creditors are: IDA (47.8%), ADB (17.8%), IBRD (17.2%), while the largest bilateral creditors are: Germany (41.5%), Japan (17.4%), Russia (12.5%).

The indicators of the fiscal sustainability don’t exceed the critical thresholds set by International Monetary Fund (IMF) for developing countries.

|

||

| Public Debt, Quarterly Dynamics and Growth Rate | ||

|

In the first three quarters of 2014, volume of public debt increases (3.9%, 336.1 mln. GEL) compared to 2013. This growth ( 361.mln GEL) is only 32.4% of planned annual public debt. Considering that some part of loans are transfered based on delivered work, basically in the fourth quarter of a year and part of loans are budgetary aids linked to the structural reforms, which are also reported in the fourth quarter, we can assume, that the large part of the loans may be transfered in the fourth quarter of 2014. However, this doesn’t mean that recieved loans will be spent in the same period and necessarily cause inflationary processes in the economy.

In the first three quarters of 2014, external debt has significantly larger share (79.5%) in the public debt compared to the share of domestic debt (20.5%). Although, the share of domestic debt in the public debt is smaller (20.5%), it has an increasing trend. In this period this indicator increases (4.9 percentage points) compared to 2013. Increase the share of domestic debt implies taking the resources from the economy (private sector), which may hamper economic development, but due to the fact that capital market is very small in Georgia, this does not threat the economy yet.

|

|

|

Source: The Ministry of Finance of Georgia

|

||

| Public and External debts-to-Nominal GDP Ratio | ||

|

Public debt-to-GDP ratio is one of the most important indicators to measure fiscal sustainability in the country. The critical threshold of this parameter, defined by the International Monetary Fund (IMF) for developing countries is 50%*.

In the first three quarters of 2014, public debt-to-GDP ratio is 30.6%**, which does not exceed the critical threshold, set by the IMF.

In the period, 2009-2013, the indicator of debt-to-GDP ratio does not exceed its critical threshold defined by the IMF.

* – IMF – Guide for Public Debt, 2013

** – Forecasted export 2014

|

|

|

| Source: The Ministry of Finance of Georgia | ||

| The Ratio of Public Debt-to-Budget Revenues | ||

|

Public debt-to-budget revenues ratio is also one of the most important fiscal indicators. The critical threshold of this parameter, defined by the IMF, is 300%*.

In the first three quarters of 2014, the public debt-to-budget revenues ratio is 122.6**, which is below the critical edge. In 2009-2013 years this figure does not exceed the limits of the critical threshold.

* – IMF – Guide for Public Debt, 2013

** – Forecasted budget revenues 2014

|

|

|

Source: The Ministry of Finance of Georgia

|

||

| Public and External Debt-to-Export Ratio | ||

|

Another important indicator to measure the fiscal sustainability is public debt-to-export ratio. The critical threshold for developing countries, set by the IMF, is 200%*.

In the first three quarters of 2014, public debt-to-export ratio is 160.7% and external debt-to-export ratio is 127.3%**. None of the parameters exceed the critical thresholds set by the IMF.

In the period, 2009-2012, the indicators of debt-to export ratio exceed their critical thresholds defined by the IMF, but the downward trend is observed since 2013.

* – IMF – Guide for Public Debt, 2013

** – Forecasted export 2014

|

|

|

| Source: The Ministry of Finance of Georgia | ||

| Public Debt Service-to-Export Ratio |

|

Public Debt Service-to-Budget Revenues Ratio |

|

|

|

|

Source: The Ministry of Finance of Georgia

|

Source: The Ministry of Finance of Georgia

|

|

|

In the first three quarters of 2014, the indicator of public debt service-to-export ratio is 10.6%*, which doesn’t exceed the critical threshold of this parameter defined by the IMF (25%).

In the period, 2009-2013, the annual indicator exceeds the stability threshold only once in 2009 (2.1 percentage points) and reaches 27.1%.

* – IMF – Guide for Public Debt, 2013

** – Forecasted export 2014

|

In the first three quarters of 2014, the indicator of debt service-to-budget revenues ratio is 8.1%**, which doesn’t exceed the critical threshold set by the IMF (35%)*.

In the period, 2009-2013, the indicators of debt service-to-budget revenues ratio do not exceed the critical thresholds of fiscal sustainability for corresponding periods too.

* – IMF – Guide for Public Debt, 2013

** – Forecasted budget revenues 2014

|

|

|

||

|

||