Monthly Tourism Update (December, 2021)

- The number of international travelers increased by 249.2% in December 2021, compared to the same period of 2020, and declined by 73.3% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 226.4% (2021/2020) and declined by 69.9% (2021/2019), and the number of international tourists increased by 239.1% (2021/2020) and declined by 53.7% (2021/2019).

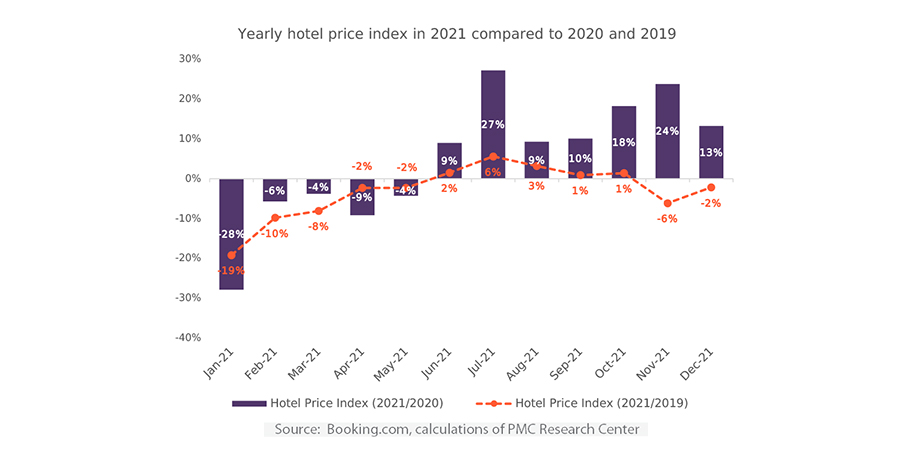

- At the beginning of 2021, the Hotel Price Index (HPI) was negative compared to both 2020 and 2019, however the monthly prices showed a significant YoY increase from June 2021 onwards and recovered considerably compared to 2019 levels.

- In 2021, the average monthly prices of hotels exceeded both the pre-pandemic level (by 23.7%) and the 2020 level (by 39.1%). Looking at specific categories, the price increase has been most significant for 5-star hotels (by 12.1% compared to 2019 and by 51.4% compared to 2020), while for 3-star hotels the price increase has been least significant (by 4.8% compared to 2019 and by 20.1% compared to 2020).